Industry Research: Walmart and Target’s Differing Market Strategies

Have you ever seen a brand you’re familiar with and thought to yourself…‘Wow, this seems like a perfect location for them’? At the risk of oversimplifying and stating the obvious, companies locate where they think their target customers will be. When we look at locations in the aggregate, we can build an understanding of who a company targets, what it suggests about their location strategy & target demographic, and how it compares to competing brands.

With just a few lines of code (well, maybe a bit more than a few) and some nifty visualizations, we can develop a baseline understanding of a company’s location strategy and even more fun, where they might go next.

In the first installment of the series, we’ll profile two big box retailers that you probably know well — Walmart and Target. What does the data say about their customer base? How does that compare to what you think you knew about them?

Interested in comparing these brands head-to-head and others? Check out this visualization for more insights and data.

Bottom Line, Up Front

The data shows that a typical Walmart is located in zip codes with high population, below-average income, and moderate economic activity. The typical Target is located in zip codes with very high population — and even larger surrounding area population — in addition to above-average income, high economic activity, and high population density.

Targets’ high surrounding area population (within ~10 miles of the zip code center) and high population density (people per square mile of land) show that it primarily locates in areas closer to cities, while Walmart locates in towns with high population but further from city centers.

Comparing the two brands, Walmart is more likely to locate in population centers away from metro areas with lower average income and population density while Target is more likely to open in and around metro centers with a higher surrounding area population and higher economic activity (surrounding restaurants, gyms, etc.).

Geographic Insights

Visualizing the geographic concentration of stores for the two brands shows a fascinating difference in location strategy, emphasizing the differences seen in the data above. What do you see when first looking at the maps?

Notice how Target — the map on the left— has strong concentrations of intensity (count of stores) in and around the coast and middle-of-America city centers. Just looking at the map you can see that cities — Los Angeles, Chicago, NYC, Philadelphia, DC, Boston, etc. — are the hubs for their strategy with a halo effect around them to capture higher income suburbs. After that, they look for targeted locations in the remaining states that likely represent population centers, for example college towns, state capitals, or other metro areas in less populous states.

Walmart, on the other hand, splits the country effectively in half, covering nearly all of the eastern half of the country , and has a more city-driven strategy in the western half of the country. Notice how much additional coverage Walmart has than Target off the coasts. Practically the whole map is covered from the center of the country to the Atlantic Ocean! This validates the earlier insights around their coverage in areas with that have high immediate area populations but lower surrounding.

By geography, over half of Walmart stores are in states classified as the South, compared to just a third of Target’s stores. Target has a higher percentage in the West, most notably in California. Walmart also has ~15% of its stores in zip codes we would classify as Rural while 90%+ of Target’s stores are in areas we classify as Urban.

Demographic Insights

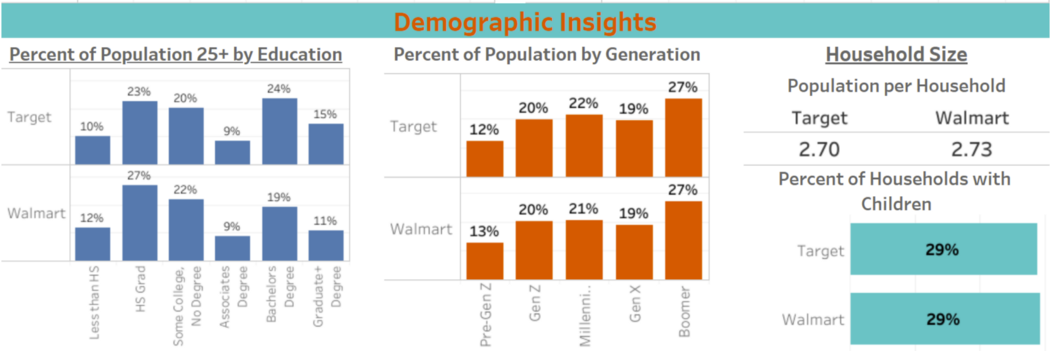

Interestingly, we see few differences in the demographic profile of customers. Target has a slightly higher percentage of the adult population with a Bachelors+ degree (~40% vs. ~30%), but otherwise by generation and household size we see the data is remarkably similar.

This suggests that the primary separator between these two brands is the location where they choose to locate their stores, not necessarily the demographic nature of customer they’re targeting. The market for the goods they sell is nearly universal, and Target chooses to take a more premium approach to products, which requires them to locate in areas that align with that shopper.

What It All Means

Overall, the data seems to reinforce the branding and marketing of the companies. Walmart generally is known for competing on price — while currently expanding their online presence — while Target is known as a higher-end big box retailer. As such, we see that Target locates in areas with above-average income in and around major metro areas, and Walmart tends to locate in populous areas outside of city centers that have below average income.

Location strategy is a fascinating topic — for me at least , and hopefully you as well if you’ve made it this far. It can be thought of as something that only large companies have the resources and talent to strategize, but companies of all sizes can benefit from data when looking to expand. You don’t need the fanciest model to benefit — simpler and more direct is better than nothing at all, and sometimes even better than the fancy models.

In addition to profiling companies, as we saw above, we can also expand these insights to find new areas that match certain characteristics. Let’s say you’re a retailer targeting Millennial shoppers with high income in urban areas in the Northeast. This won’t tell you the exact address of where to locate, but data can narrow down our search from the whole Northeast to only the areas that match that profile, allowing business owners to spend more valuable time searching in targeted areas for the perfect intersection, street, or location instead of more time in more locations guessing which might be best.

Interested in this topic? Get in touch with me here or by email at jordan@jordanbean.com.