Acquisition Intelligence: The JetBlue-Spirit Airlines Acquisition

JetBlue surprised the business world by making an unsolicited $3.6B bid for Spirit Airlines after Spirit received an initial buyout proposal from Frontier Airlines this past February.

A quick surface-level reaction for anyone that has flown regularly might be that there’s not strong strategic overlap between the brands. JetBlue typically services main hubs with average flying customers. Spirit is known for catering to budget-conscious customers in sometimes out-of-the-way airports.

This thinking is backed up by commentary from the JetBlue President herself. Quoting from the WSJ article:

“At first glance you may not think we’d make a great pair,” Mr. Hayes and JetBlue President Joanna Geraghty wrote in a memo to employees. “When you dig deeper, you’ll realize we could be a perfect match.”

So, let’s dig deeper, using data. What makes this a perfect match (if anything)? What does JetBlue gain from the acquisition? What does a combined data and strategy view look like?

The Industry

The airline industry is a fascinating study in how markets evolve, everything from the impact of deregulation on free markets, how consolidation via M&A affects competition, how to adapt to changing consumer habits, and more.

Today, though, there are a couple important pieces of information to know about the airline industry:

The barriers to entry are very, very high due to — among other reasons — the amount of capital (money) needed to start a business, developing consumer trust, and gaining regulatory approval

Expanding to new markets is not as easy as starting up a route to fly there

The market is top-heavy with four carriers (American Airlines, Delta, Southwest, and United Airlines) — that represent over 70% of passenger volume for all North America carriers.

With the above points in mind, let’s consider how a Spirit acquisition might benefit JetBlue despite the lack of core customer overlap.

Access to New Markets

As a consumer, it might be easy to think — like many other businesses — an airline could just choose to start operating in a new market. A restaurant like Chipotle could identify a new market opportunity and open a store there.

Airlines face much more complex logistics to open in a new market. The most obvious of those is gate availability at airports. Think of each gate in an airport as a piece of real estate, like a home. It rarely comes becomes available and its expensive & time consuming (or sometimes impossible) to build more.

Every gate that a “big four” (or any other) airline occupies is one less available opportunity for JetBlue to fly to that airport. Take Chicago’s O’Hare airport as an example. In 2019, there were almost 85 million passengers that passed through the airport, making it the largest in the US by passenger volume. This would suggest a large market opportunity for any normal operating business.

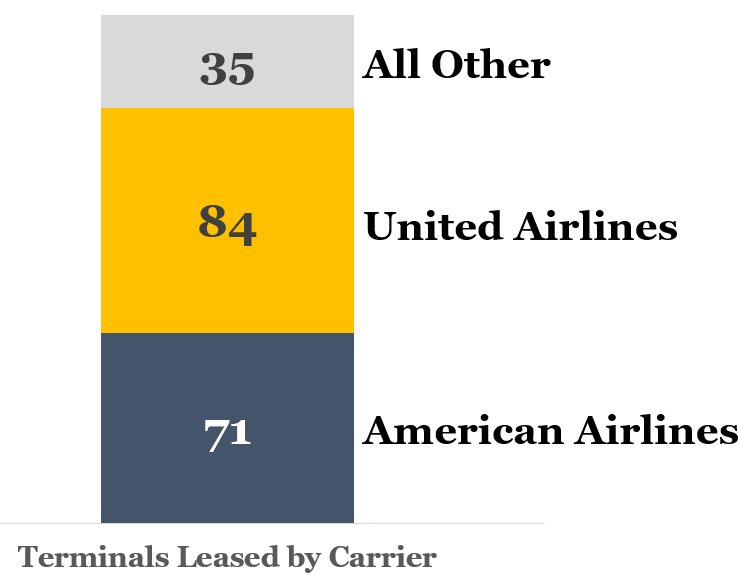

However, of the 193 gates at O’Hare, two airlines — American and United — lease more than 80% of them.

Source: FlyChicago facility data

So, naturally, this market concentration limits JetBlue’s ability to scale in the market, even if they wanted to.

In 2019, JetBlue had just under 250,000 passengers depart from O’Hare, and they primarily flew to 3 destinations: Boston, JFK (New York City), and Fort Lauderdale. In the same year, Spirit Airlines had over 1.6M passengers depart from O’Hare, and those customers flew to all areas of the country.

An acquisition of Spirit immediately unlocks 1.6M additional passenger capacity in the market with added destination flexibility. This scale would take years to achieve — if ever — without an acquisition since 80%+ of the gates will effectively never be on the market.

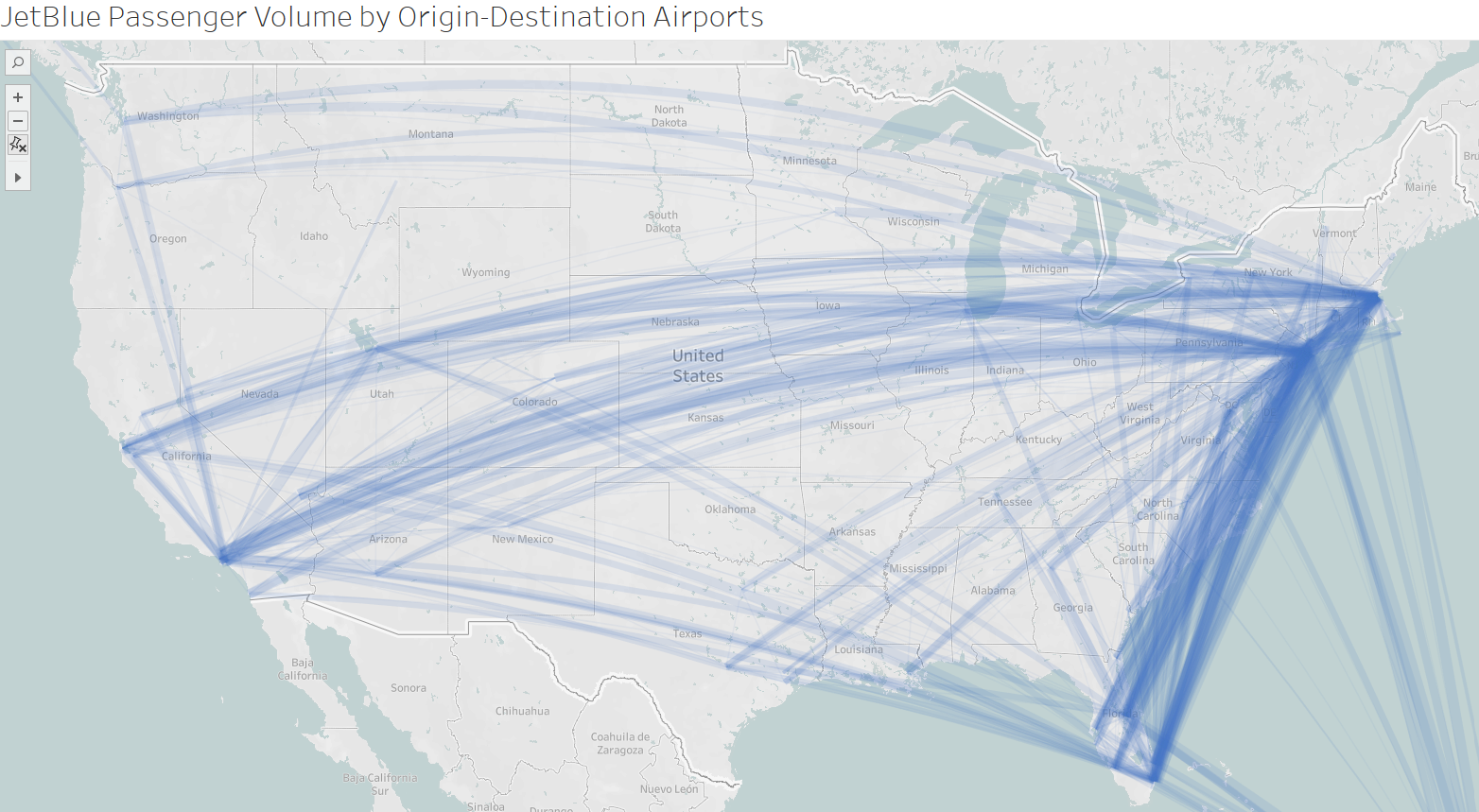

Size of line represents number of passengers. Data from the Bureau of Transportation

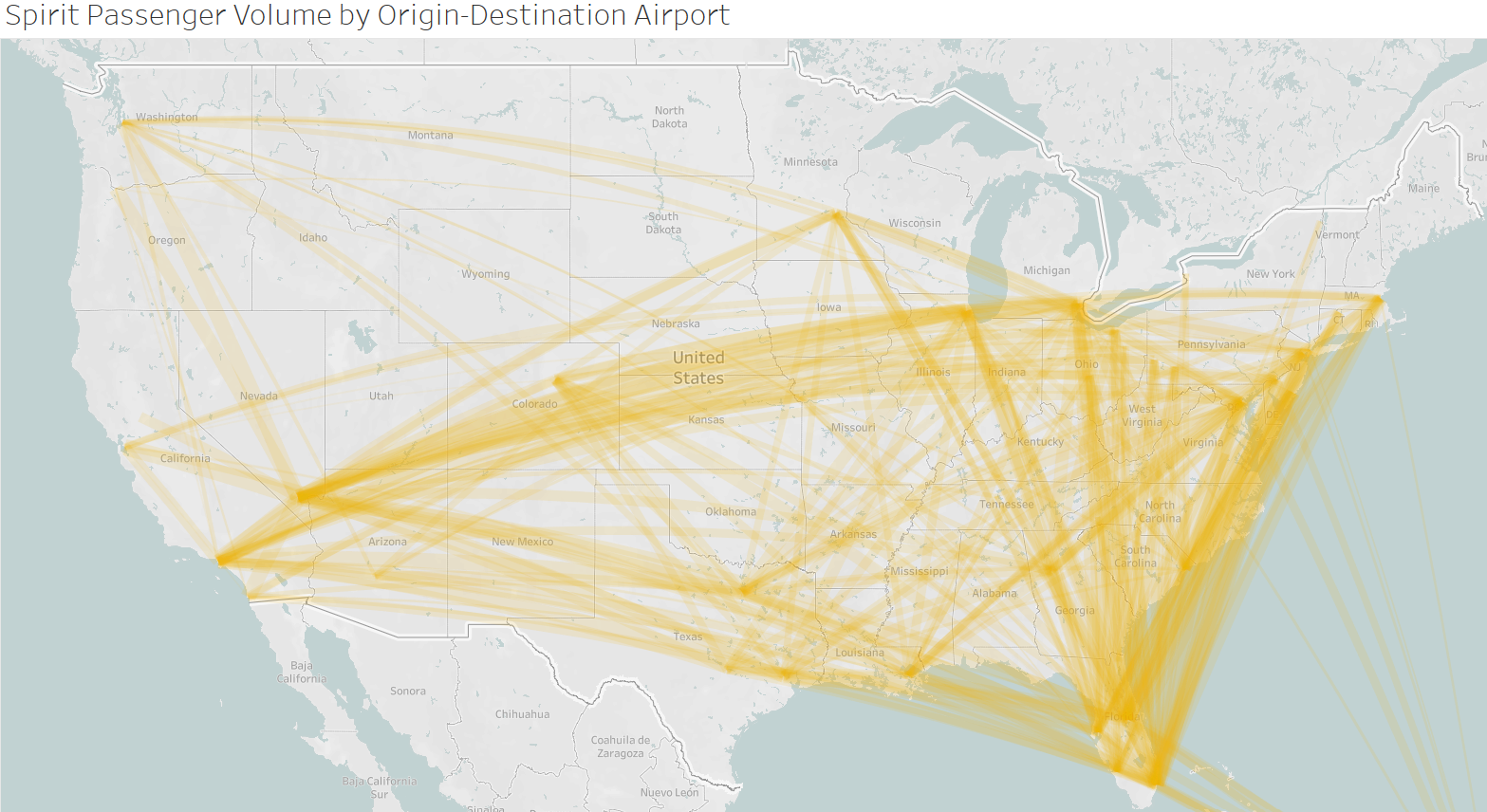

Let’s take a step back and look at the geographies served by each airline more holistically. Considering just domestic travel, both airlines have a heavy flow of passengers up and down the east coast, and both cross the country, typically starting in the northeast and ending in the southwest.

Origin-Destination flight volume, JetBlue (Data from Bureau of Transportation Statistics)

Origin-Destination flight volume, Spirit (Data from Bureau of Transportation Statistics)

There are differences in the route traffic too. Bringing these two views together, we can see that an acquisition of Spirit unlocks passenger volume and market opportunity for JetBlue in the Midwest-Southeast regions where we see more Spirit activity than JetBlue.

Origin-Destination flight volume by carrier (Data from Bureau of Transportation Statistics)

A view of select key markets by 2019 passenger volume shows several areas where JetBlue can grow, in addition to new markets available for entry.

There’s substantial opportunity in a key market like Dallas (DFW), a top 5 market in the US by passenger volume, which is only unlocked through acquisition.

DFW is the hub for American Airlines, headquartered nearby. American controls 85% of the passenger traffic from the airport and before COVID had plans to partner with DFW to build and lease most of the gates in a new terminal. This is another example — of many — where market capacity is controlled and constrained by one or more of the “big four” and organic expansion opportunity is severely limited.

The above only considers the ability to physically park a plane at the airport, which is just one small part of a much more complex bigger picture. Can the airport support the type of aircraft that the plane flies? What about staffing up in the region?

Taken together, the timeline, logistics, and ability to expand operations in new (or even existing) markets is costly, lengthy, and filled with uncertainty.

Another element of strategic value for an acquisition is simply the amount of time it takes to grow as an airline. For example, Delta recently announced that it will begin operating its first of 155 new Airbus planes in May. Delta originally placed an order with Airbus in 2017 for 100 plans, which later increased to 125 then 155. Delivery of planes is expected to continue until the order is completed in 2027.

That’s 10+ years from start-to-finish to take delivery of 155 planes. Spirit has a fleet size of about 170 planes, giving JetBlue faster access to not just the customer volume and gate access but also the planes themselves.

Segmented Value Proposition

Another interesting facet of this acquisition is the segmented brand value that JetBlue could offer. Airlines, like many industries, compete with price as a top-of-mind consideration for many customers. Sure, there’s also flight time, availability, brand equity, and more, but all else equal, price matters to many everyday fliers.

Large airlines have responded by decoupling the flight experience and charging for distinct parts of process. Want to check bags? Board early? Pick your seat? Those will cost you now.

The decoupling of the flight experience also leads to a fragmented brand. On one side, a large airline is trying to compete with budget carriers with its “Basic Economy” ticket, while at the same time they’re trying to appeal to business travelers with their business class ticket. In the same plane, there’s an enormous variability in the experience they’re trying to offer and price being charged.

When Spirit decouples a service and charges for it, they’re a shrewd budget airline. When a big four carrier does it, it’s called a junk idea and the Department of Transportation released 50 pages of customer complaints during the period of time when the ticket type first rolled out.

Like retailers, JetBlue may now have an opportunity to better segment their brand to serve distinct types of customers. This isn’t dissimilar to the way that a retailer will have multiple brands in the same category with different goals. Grocers Trader Joes and Aldi are owned by the same parent company, but offer distinct customer experiences and tailor how they market to these value propositions.

Is it Worth the Money?

I’m not an investment banker by trade so I won’t try to put a concrete value on the tangible and intangible assets of Spirit Airlines.

However, based on the above, I’d say that any opportunity to gain access to space and passenger volume in a tightly controlled, top-heavy industry is one worth looking at very closely, regardless of the perceived difference in customer overlap. It’s like having the opportunity to purchase land on Manhattan — it doesn’t matter what’s on the land right now, you’d rather have it with the ability to shape its future than not have it at all.

In 2019, JetBlue was the 7th largest by passenger volume with ~43M passengers. American Airlines — the largest — had 215M passengers, and the “smallest” of the big four airlines, United, had 162M. Any opportunity to grow towards the scale that’s needed to compete long-term in this market has value, and the opportunity to acquire a top-10 airline by passenger volume isn’t something that comes around often.

Interested in this topic? Get in touch with me here or by email at jordan@jordanbean.com.