Using Data for Site Selection as a Small Business

Over the past couple years, I’ve had the pleasure to speak with several small businesses facing similar problems: How can they use data to help grow their business and find their next location? Its a lack of time and available data — not a lack of desire — that holds many of these businesses back from using data in growth decisions.

Without a doubt, site selection is complex and uncertain. There are no guarantees that a new location will be successful, regardless of whether data is used or not. Data can help bring conviction and confidence to these decisions, in addition to helping you make more efficient use of your time. It can confirm that the right environment is in place to succeed.

There are three primary areas where data can support the location selection process for small-to-midsize businesses:

Narrow the Funnel — Go from bigger areas (“The Northeast”) to smaller (“These [zip codes, cities]”)

Understand & Prioritize— Rank your remaining geographies by what matters to your business

Validate the Location —Understand the surrounding area

Site selection starts with understanding what matters to your business. Without an understanding of the demographic or economic factors that must be in place to be successful, site selection is as much guesswork as anything. Do you need a large population? High income? High presence of certain age brackets? Do you rely on office worker foot traffic? Is the presence of certain business types important (restaurants, healthcare facilities)?

This step is critical to starting the process. We can’t narrow the funnel without knowing which criteria to use when narrowing. Customer research, market expertise & experience, and competitor location analysis can all help inform the important criteria for your business.

Imagine we wanted to open a new boxing gym in the coastal Southeast US. Not a “train-in-the-boxing-ring” gym, but rather group workouts and individual training sessions with heavy boxing bags and instructors. Think of a Title Boxing.

What might be important to us with that business type in mind? A few items that come to mind for me are:

Population Size and Income: This type of gym is typically a premium offering compared to, for example, a Planet Fitness. We need sufficient population size to generate a customer base, and a sufficient income level to not balk at $100+ per month for membership.

Residential & Commercial Population: Some people work out before work, some during the day, some after work. Locations near both residential and commercial centers expands our available market from just people that live in the area to both people that live in the area and commute in for work.

Competition: Competition here is both near and direct competitors. Consumers must pick us over both a traditional gym experience and other boxing-focused workouts.

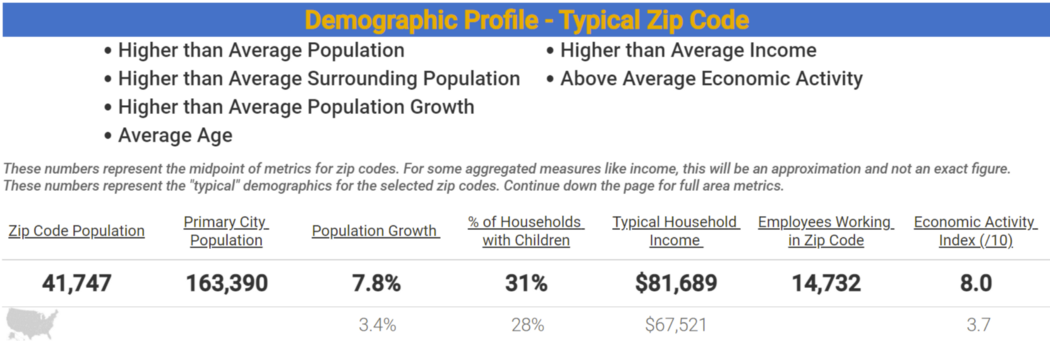

In addition to the brainstorming above, we can “reverse engineer” the location profile of businesses that we think fits our location profile. For example, take a look below at the “Typical Zip Code” for the 26 Title Boxing locations spanning from Virginia down the coast to Florida.

Typical zip code profile for Title Boxing locations on the Southeastern coast

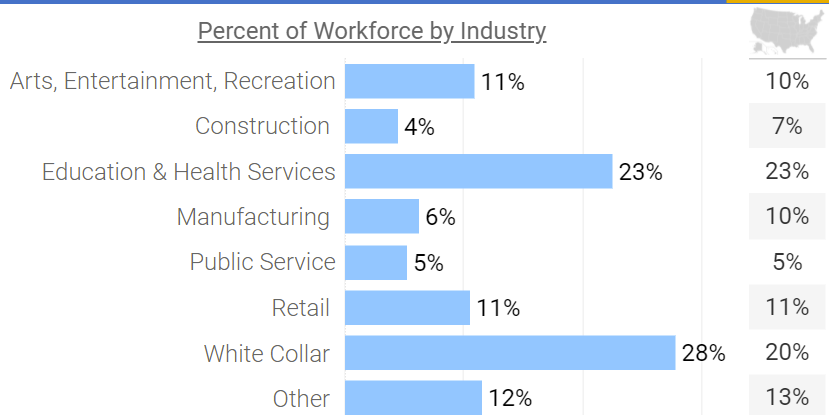

Workforce by Industry for the Population in Southeastern Title Boxing Zip Codes

Title Boxing locations on the Southeastern coast tend to have higher household income (+20% compared to the national benchmark) in addition to higher population size, population growth, and economic activity (a custom designed measure of gyms, restaurants, retail shops, etc. in a zip code). There’s also a higher percentage of the resident population employed in White Collar jobs compared to the national average (+8 pts.).

Narrow the Funnel

Now that we’ve identified our target market demographics, we might ask ourselves: Where are the areas that fit this demographic profile? Which counties, cities, or zip codes in our target states have higher population size & income, high growth, high employment, and high economic activity in suburban-urban environments?

Narrowing the funnel is when we shrink larger geographies using data as a filter. If we know we can’t possibly be successful in a zip code with, for example, less than 5,000 population, we can eliminate any zip code with that designation. We can use any identifiable data point to keep or exclude geographies depending on what we’ve identified is critical to our business’ success. If we’re concerned about being too restrictive, we can use conservative filters (such as 20% lower target population than we think).

Using a tool we built to find geographies by selected demographics and economics, in just a minute or two we can narrow our field of search (our funnel) from 5 states spanning 3,836 zip codes to just 54 zip codes that have:

Zip Code Population of 25,000+

City Population of 150,000+

Growing Population

Household Income of $75,000+

High percentage of the population in the workforce

High economic activity

Primary industry of employment in White Collar

If we wanted, we could also take a bigger picture view and look at counties and cities instead of the zip code level. This helps us offset some of the disadvantages of using zip codes, which aren’t necessarily designed as perfect geographic boundaries but do give us more specificity (smaller resulting search areas).

Understand & Prioritize

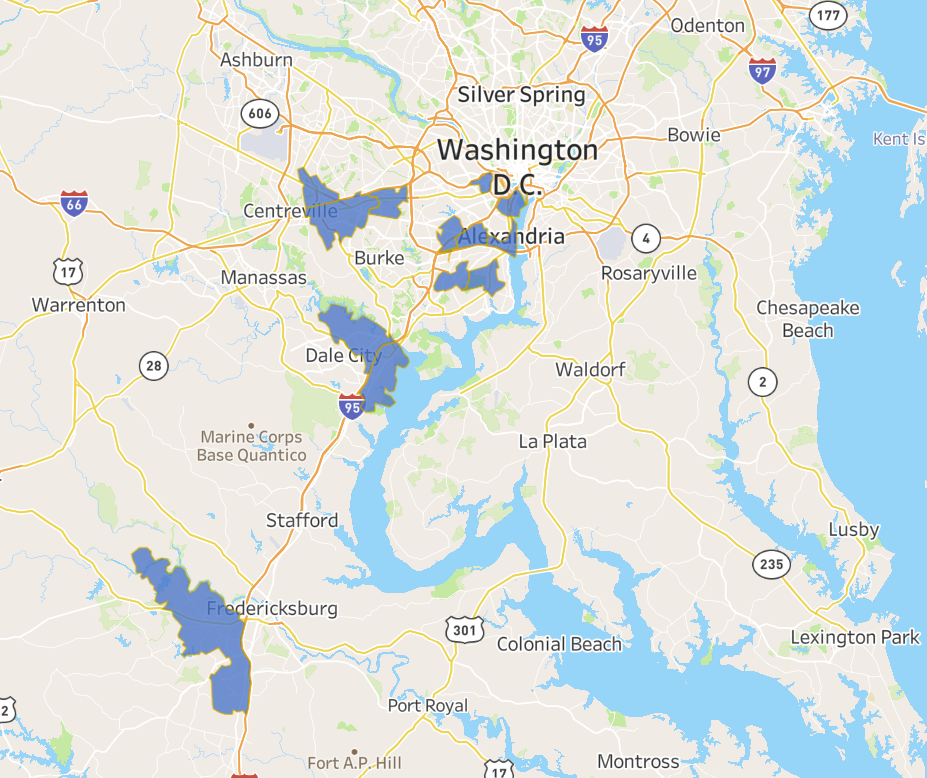

Let’s take a look at where the 54 zip codes that meet the above criteria tend to be:

There are clusters of zip codes in Northern Virginia (near Washington DC), the northwest corner of Raleigh NC, and north of Atlanta. There are also multiple locations surrounding Tampa FL, north of Miami, northeast Jacksonville, and south of Charlotte NC.

From here, we can create a scoring mechanism to prioritize the zip codes based on our judgement or business goals. Is population size more important than income? Is the percentage in the workforce and in white collar jobs more important than a growing population?

We can create a formula that weights the components of our target market with respect to how important they are. For demonstrative purposes, I included population (zip code and primary city) at 10% weight each, income at 15%, economic activity at 20%, gyms per 10K population at 20% (less = better), white collar workforce at 15%, and population growth at 10%.

In other words, our most important criteria are economic activity, competition, income, and white collar workforce. For your business, you could include more data points or less. You can create whatever weighting makes sense for the relative importance of each included data point to your business.

This allows us to take an unordered list and give it some semblance of prioritization and order. It doesn’t mean the highest score is perfect nor that we couldn’t be successful with the lowest score. Rather, it helps us use data as a guide to understand which areas exhibit more of the traits that are important to our success.

Using this method, we can create a tops down view to help us prioritize. Which metros have the highest average score? Then, which cities in that metro? Finally, which zip codes in those cities?

Market scoring based on the above formula (/100)

The data, based on our weighting above, suggests that within our 54 remaining zip codes the Tampa metro area appears to have the highest potential, followed by Charlotte and Atlanta. By city, Tampa, Cumming (GA), Atlanta, and Charlotte have the highest scores. We can use our maps above — or drill down a level deeper with our score — to prioritize the zip codes that fit our initial screen within those metros or cities.

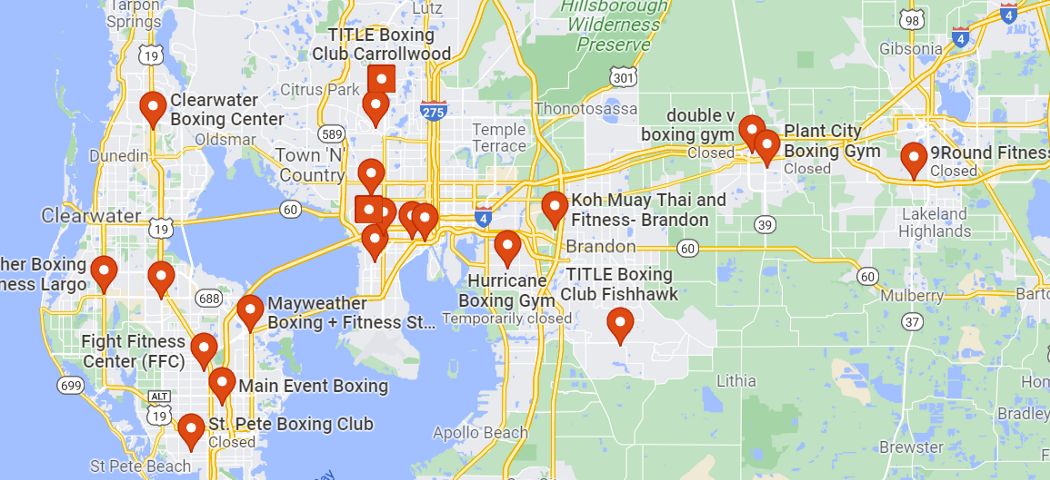

We can then pick our top scoring cities to do a deeper dive into more specific data. How many boxing gyms exist today? Where are they located? How satisfied are consumers with the options that exist today? Which gyms are most popular, suggesting we may want to look in other areas?

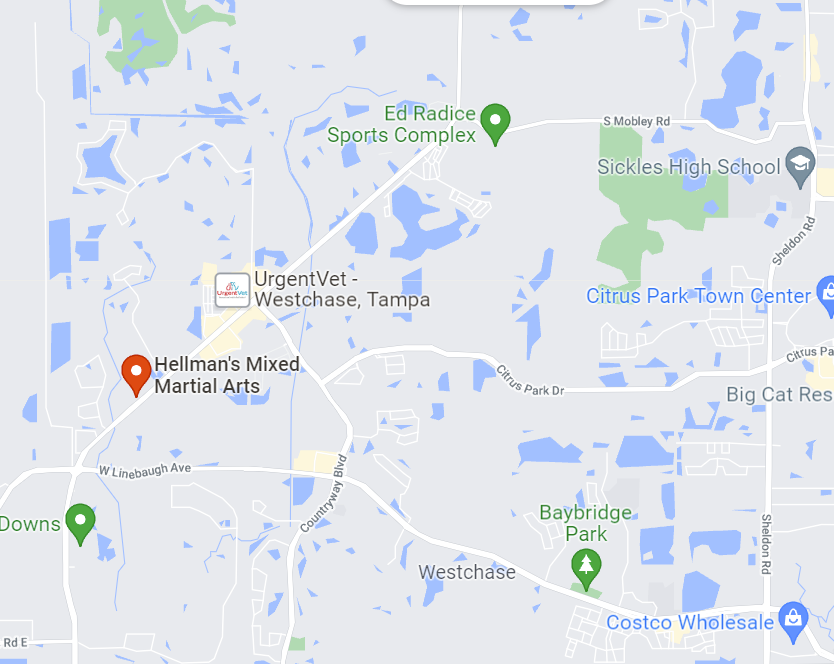

We had 3 zip codes in the Tampa-St. Petersburg metro area. Let’s check out the competition. Conveniently, we have both a Title Boxing Club and 9round Fitness (another boxing-related chain gym) located in the first searched zip code, 33626. We may want to explore the area around Britton Plaza, the southern part of the zip code, which looks like a high traffic area with little competition.

Search for “boxing gym” on Google Maps in zip code 33629

Our highest scoring zip code in Tampa, 33626, has little direct competition. We also see large swaths of uninhabitable land, so this could be worth further pursing — is there enough population density for us to be successful? Can we reach a sufficient population within a reasonable drive time anywhere in this zip code?

Search for “boxing gym” on Google Maps in zip code 33626

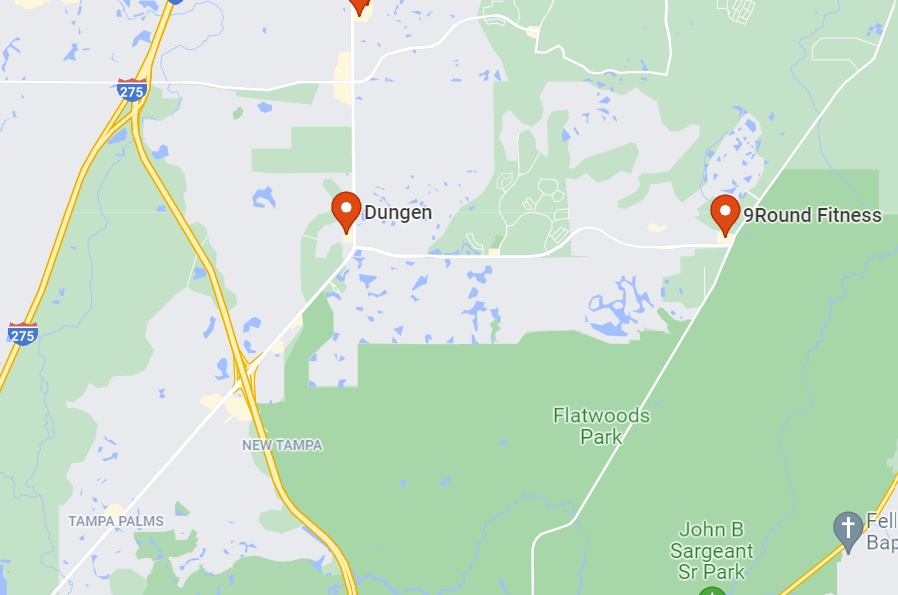

In our last zip code, 33647, we see another 9Round and a business called Dungen, which has no reviews and presumably is either not in business or is a very niche competitor.

Search for “boxing gym” on Google Maps in zip code 33647

Plenty of boxing gyms exist in the Tampa metro area — just look at the results for the generic “boxing gym” search below — but by “narrowing the funnel” and creating our prioritization, we’re able to find areas that may still be untapped potential in the market. There may be good reasons that fewer boxing gyms have located in these zip codes, but it gives us a more focused place to start searching.

Search for “boxing gym” on Google Maps

Validate the Location

Now, imagine you’ve worked with a commercial real estate broker after selecting certain zip codes / cities from the above prioritization. They’ve presented you with potential sites and you need that last bit of conviction before moving forward.

Data can help bring conviction by confirming that your target market exists within a boundary of your location. For example, maybe you’ve found that you should have a population of at least 50,000 within a 5 mile radius or at least 20,000 people working within a 1 mile radius.

We made a basic population estimator tool that you can use here (or read about here). We also have more advanced tools that give more information like percent of households by income level and percent of population by age, in addition to the estimated employment population.

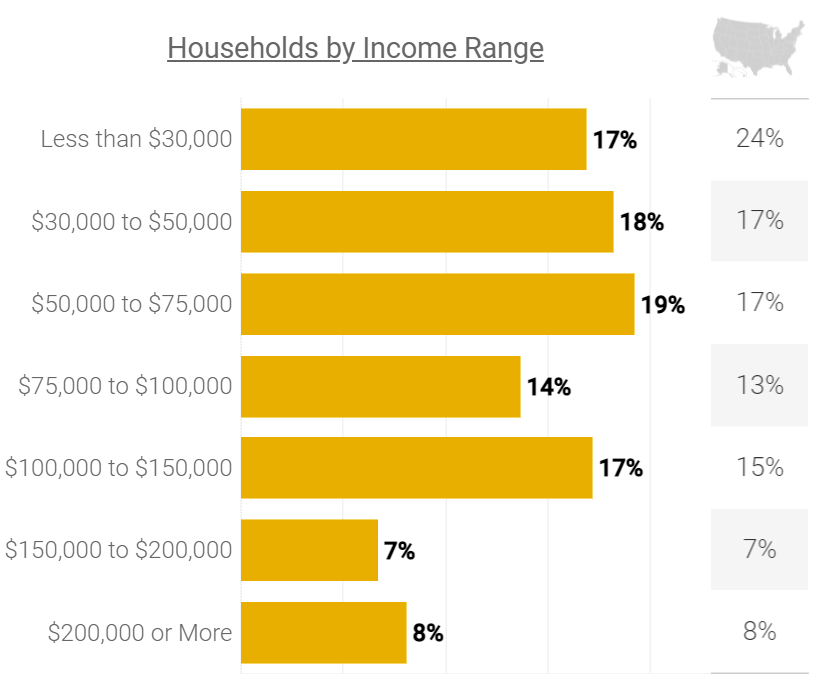

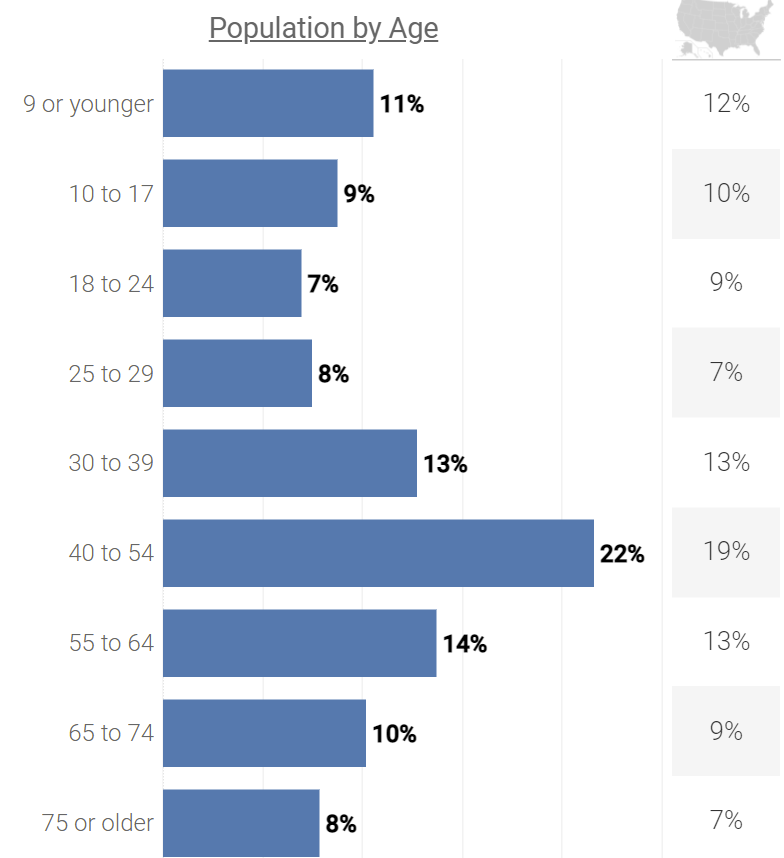

Let’s say we had identified these two potential sites for our gym that are within a ~10 minute drive of each other. Knowing what we do about our target market, which do you think is better based on the data?

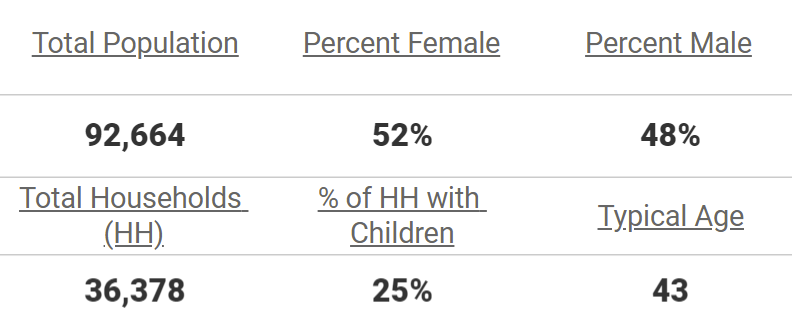

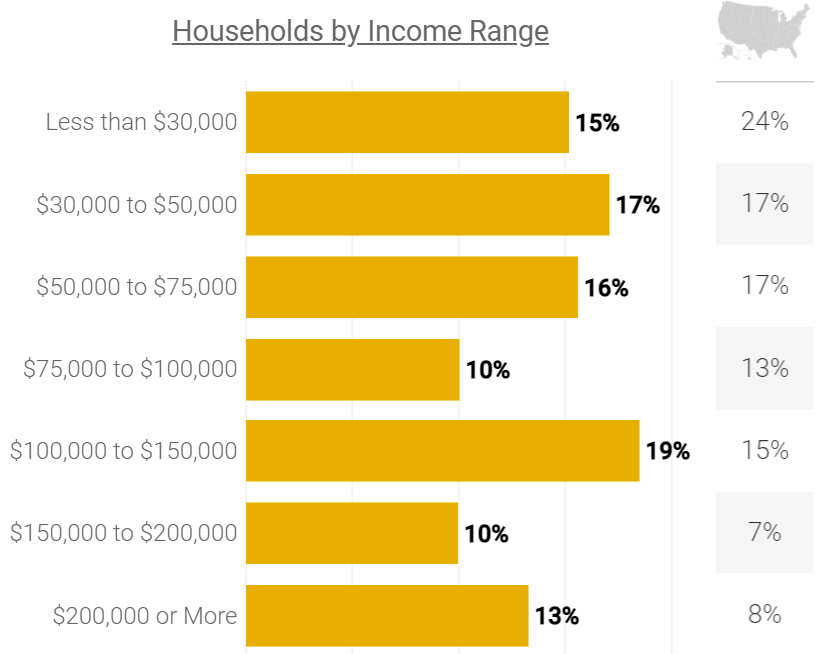

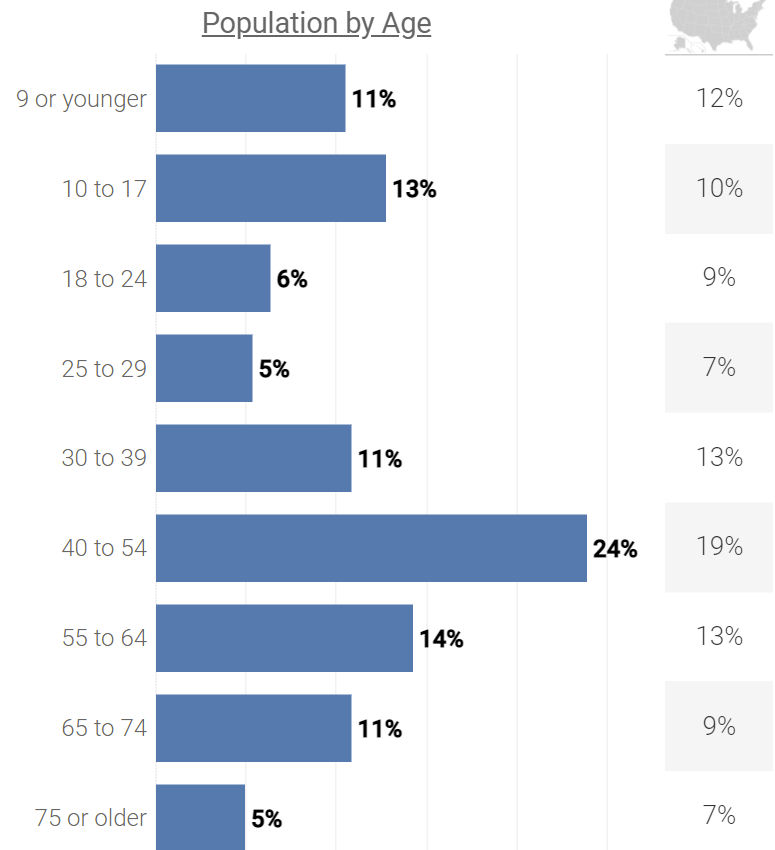

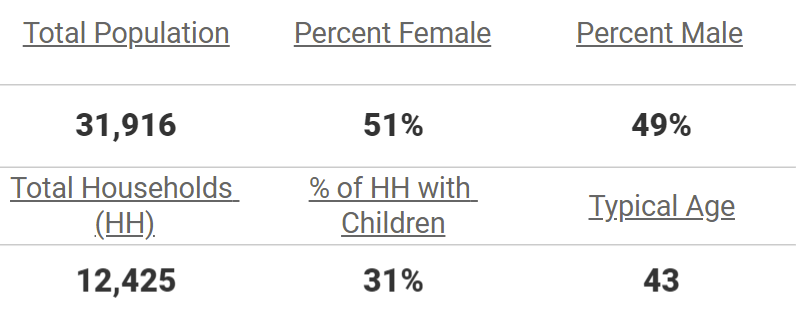

Within a 3-mile radius, location 1 has a population of about 92,000 people and about 25,000 people working in the area. Other demographics are below.

In the same radius, location 2 has a population of about 32,000 and 6,000 people working in the area. The remaining demographics are below.

Location 1 is a Title Boxing gym, Location 2 is an Urgent Care clinic. Both have above average income, while location 1 has a slightly younger percent of population 39 or younger. It also has significantly higher population, households, and employment, suggesting population size may be more important than income to them once a certain income threshold is reached.

Conclusion

As mentioned earlier, site selection or finding growth markets is incredibly complex. Data can only scratch the surface of making this decision. There’s also considerations like available labor, cost of living, cost of office/retail space, working with a broker to find the right property (which is just as important, if not more, than the right market), and more.

Strategic use of data — matching the right data to your company’s goals — can be a way to help you make more efficient use of your time. Instead of trying to figure out “Where should we grow on the coast of the Southeast?” you can instead ask “Where should we grow in these 2–3 cities?”.

Asking more focused questions leads to better discussion and better answers. It’s much easier to research a handful of markets in more detail than looking at summary statistics for a larger number of markets. Using a methodical, data-driven approach to narrow your funnel then understanding & prioritizing locations can help you screen out what won’t work and spend more time on what could work for your business.

Interested in this topic? Get in touch with me here or by email at jordan@jordanbean.com.