The Failing iBuyer Business Model

Some companies mentioned in this post are publicly traded. This analysis is not investment advice, is not nationally comprehensive, and may contain errors in the source data or analysis. This analysis is our perspective based on localized available data and may not be current or up-to-date.

We researched and wrote a couple months back about the iBuyer business model (companies that buy and sell homes in short periods of time, like Opendoor). The long story short was - we concluded the economics were fragile in the strongest housing market in history, and something had to give to achieve a long-term sustainable business model.

Since we wrote, interest rates have rapidly risen and the housing market has dramatically slowed. In the face of this, the iBuyer business model is quickly deteriorating. In early November, Opendoor reduced its workforce by nearly 20%, and this was after other rounds of earlier cuts. Shortly after, Redfin announced the closure of its own iBuyer business with a commensurate reduction in workforce.

The market has changed and iBuyers are on the hook with illiquid assets that have ongoing maintenance and upkeep cost with declining value. Our previous research - confined to Wake County, NC, home to Raleigh and surrounding communities - suggested that the company achieved returns of 8.4% on its typical home purchases made in the county in 2021, in addition to their service fee of 5%. We pulled the data again for Wake County, and the story has changed.

Declining Market, Declining Profitability Trend

For sales completed in the calendar year 2022, our research shows that the median difference between home purchases and home sales is now down to +6.7% in Wake County (plus a 5% service fee), but that masks a rapidly declining trend. Our data suggests that the median change in home purchase and sale price for homes sold in August, September, and October were all negative - in other words, their typical home sale (excluding the service fee) lost money compared to the purchase price for three straight months. By September, the typical home was selling for 6.5% below the purchase price and early indications (incomplete data) for homes sold in October are that the number remained well in the red.

Further still, the time to sell remains elevated. We estimated the typical time between home purchase and home sale was about 81 days for home purchases in 2021, but for homes sold in 2022, the number has been above 100 for several months. After a strong spring, the number has been trending up over the summer and fall as interest rates rose and home sales activity stagnated.

In the data, we saw particularly troubling data emerging for purchases made in the spring and early Summer. Of the homes Opendoor bought in May 2022, less than half have sold, and of those that have sold and have a recorded sales price, 74% sold below the purchase price. For purchases made in June 2022, only 30% have sold, and 95% of those sold had a lower sales price than purchase price.

Of the home purchases made in June 2022, only 30% have sold, and Opendoor lost money - excluding the Service fee - on 95% of those homes

Still Exposed

Despite dropping prices, Opendoor remains highly exposed to Wake County with its current holdings. Though there’s a delay in the data, Opendoor is the owner of record on over 220 properties in Wake County as of early November with a total purchase value of over $90M. Homes that remain on the market have been there a long time - a median time of ~130 days, or over 4 months. Misses are inevitable when buying at the scale of Opendoor, but they are getting more frequent and costly. Below are three examples of homes still in Opendoor’s portfolio - two active and one now pending.

Screenshots of Opendoor properties from the Redfin website.

The longer a home sits on the market, the more the price is lowered and the liability grows. The above screenshots are just three of many examples in Wake County, NC of homes that are listed below the purchase price and inevitably will lead to more negative months when sold. About a quarter of properties currently in their ownership in Wake County were purchased in May or earlier, representing a hold time of nearly 6 months or longer.

It’s worth noting that the company still has its 5% service fee cut even on sales below the purchase price, but commissions, proportional property taxes, upkeep, and other unexpected expenses are all still ongoing or fixed costs.

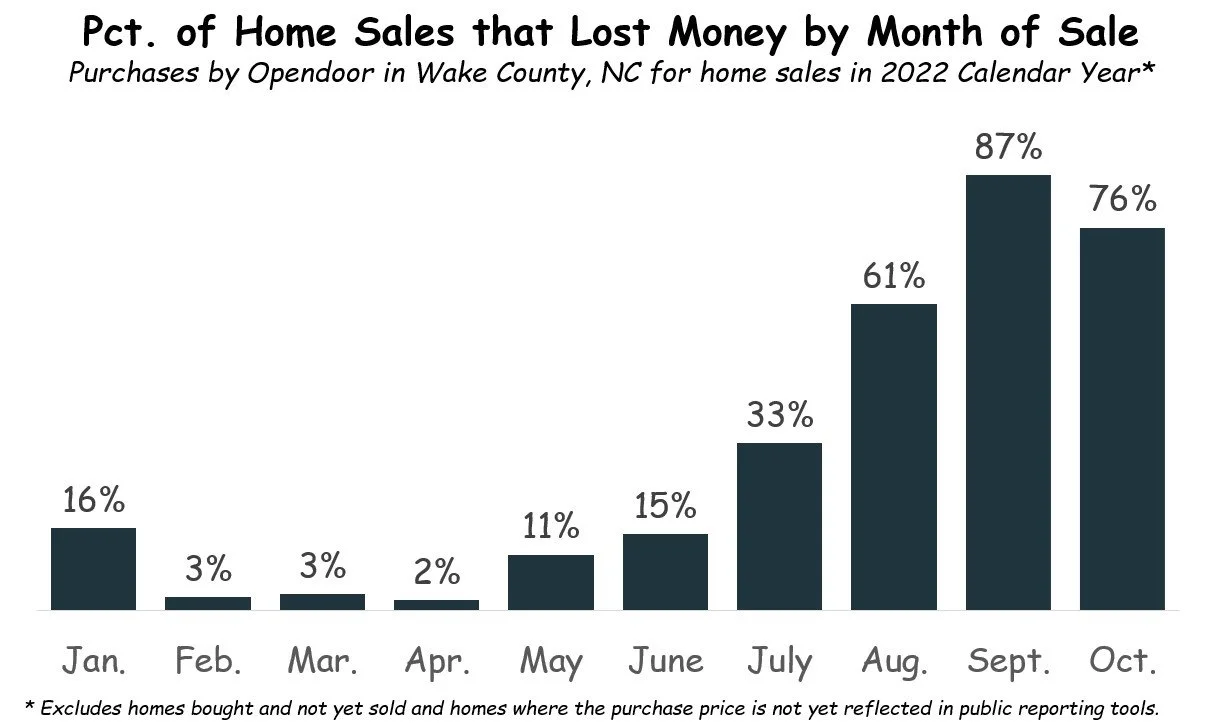

We estimated that in 2021 about 7.5% of purchases sold for less than the purchase price. That number has risen substantially in recent months. The fact that the median home change was negative in August-October suggests that more than half of homes are selling below the purchase price now. In fact, for transactions that closed in September in Wake County, we estimate that Opendoor lost money on 86% of home sales.

Unsurprisingly, the pace of home purchases has slowed in September and October. Though the records may not be completely updated, the current records show that Opendoor usually made between 40-60 purchases during the spring and summer months, but slowed to ~20 in September and the low teens in October as of this writing.

These findings - especially for the most recent month of October - may not be complete as the source records do not reflect all of the homes bought and sold in the most recent months. The trend, however, is troubling. Perhaps as the data flows through, the number of home sales that lost money will drop, but it’s highly unlikely to drop back toward the levels seen in 2021 and earlier in 2022.

The Business Model Correction

The business model cannot work offering market prices for homes - the numbers just don’t add up. Opendoor, and other iBuyers, provide a valuable service. The ability to sell a home on a seller’s schedule, for a guaranteed cash closing, without any home repairs holds significant value, particularly as interest rates rise and the likelihood of a buyer being unable to acquire financing rises.

There needs to be more risk premium and value-driven pricing factored into an offer. The service shouldn’t be for everyone. Some sellers will think they should be offered a market price - iBuyer’s need to accept that those sellers won’t be for them. There are plenty of reasons someone would sacrifice top dollar to sell fast - the home has risen significantly in value and a couple percentage points are immaterial, the seller doesn’t want to (or can’t) pay even a month of two mortgages, there’s a job-driven relocation that forces a quick sale, the seller doesn’t have the budget to make repairs. The list goes on and on. These should be the target market for iBuyer’s, not the general public home seller.

The other issue that these companies might be facing is adverse selection. If someone has a desirable home in a good neighborhood, why bother going through an iBuyer? Sellers that think they might have trouble selling - for whatever reason - may be more inclined to go through an iBuyer. The company touts its ease of sale for the buyer, and this is certainly of value, but is it at the risk of insufficient due diligence on the home? The company says they do a virtual home assessment to view the home’s interior condition and needed repairs, in addition to an “Opendoor Estimator” to assess the exterior of the home. Can the company catch everything of significance about a home that might need a repair with that model?

As we stated in our last article, both revenue drivers for the company will likely need to be adjusted for long-term financial stability - higher service fee and lower offer value. This is a must, starting with the adjustment to offer value. Sellers are conditioned to ask for market value on their home, and the company needs to convince a certain subset of sellers that a below market-rate offer in exchange for the value of their services is an equitable tradeoff.

A new twist to the industry could be to consider entering into the buy-to-rent market. Given the number of homes that are languishing - on the market for more than 4 months - it stands to reason that the options are either (1) sell at a loss or (2) generate income from rental. Income generation through rental may help them ride out periods of low market growth while also recouping some of the overhead costs to buy and sell real estate. There could be criteria in place, such as once a property sits on the market for more than 4 months or can’t be sold at break-even, that drive the decision to rent.

This would require a merger with a company that specializes in the buy-to-rent single family home market. The skillsets, personnel, and infrastructure to support rentals are quite different than the iBuyer model. The buy-to-rent company can benefit from Opendoor’s (or any iBuyer’s) access to capital, deal flow, and excess inventory. Opendoor can benefit from having a backup plan for properties that don’t sell and better insulation against near-term market trends (every home purchase is inherently dependent on the direction of the real estate market over the coming 1-3 month sales period).

The above analysis is just one market where Opendoor and other iBuyers operate. We don’t have the full picture to know whether these trends hold nationally or in other markets, but the recent layoff and industry activity suggest that trends are turning unfavorable.

The data shows the business model is going to have a difficult time weathering a slowdown in real estate activity. When and if the real estate market returns to its long-term trend of low single digit growth, a business model built on 1-3 month turnaround times cannot survive offering at market value rates. This equates to ~1% increase in sales price over the “hold” period. This means the service fee will need to increase and/or the purchase price will need to go down to build an economically sustainable, long-term business model.

Methodology and Limitations of Analysis

To complete the above analysis, we sourced data on property transaction records in Wake County, NC for the calendar year 2022. We looked at snapshots for each month to identify when a purchase was made by Opendoor by searching for the string “Opendoor” in the owner name as an initial analysis suggested the company makes many purchases under their own name. From there, we looked at when (or if) the same property was sold at a later date. We recorded the sale and deed dates, purchase price, and new owner. We joined the data together to have a full data set with Opendoor’s purchase date and purchase price in addition to the sale date and sale price. Any purchases made by Opendoor that did not contain the name Opendoor in its entity name would not be captured, and while there isn’t evidence to suggest this happens, we do not know if they purchase homes at scale under different corporate entities and addresses.

We found some limitations in the data as we ran the analysis. There were discrepancies between sale and deed dates, in addition to lagged reporting on the final sale price. Some properties had an updated deed date but the recorded sale price did not reflect the sale price by Opendoor. The records where this happened were typically sales in the most recent 1-2 months and were removed from the analysis. When the final sales prices are recorded, this may change the analysis data points, findings, and conclusions. We spot checked property records for sales in August and September on leading real estate websites to confirm that the purchase and sale price were accurately reflected.

This analysis is limited in scope to a single county in North Carolina. Real estate markets are hyper localized, and results are likely to differ in other areas where the company operates. Without running the numbers, it is unknown whether these trends hold nationally or in other areas.