Brand Research: WeWork’s Urban Market Strategy

I recently finished reading The Cult of We — a fascinating book on WeWork’s origins, founder, growth, and rapid fall back to reality. I also spend most weekdays at my local WeWork.

My daily experience is very positive, but the business is not. The stock price is so low that the company is at risk of being de-listed after just two years as a public company.

This got me thinking…

Why is my experience so good and the business so bad?

WeWork Today

WeWork leases prime offices space, sub-divides it, and rents it back to businesses and individuals. Their spaces are bright, modern, centrally located, and in high-end buildings.

Photos from Unsplash

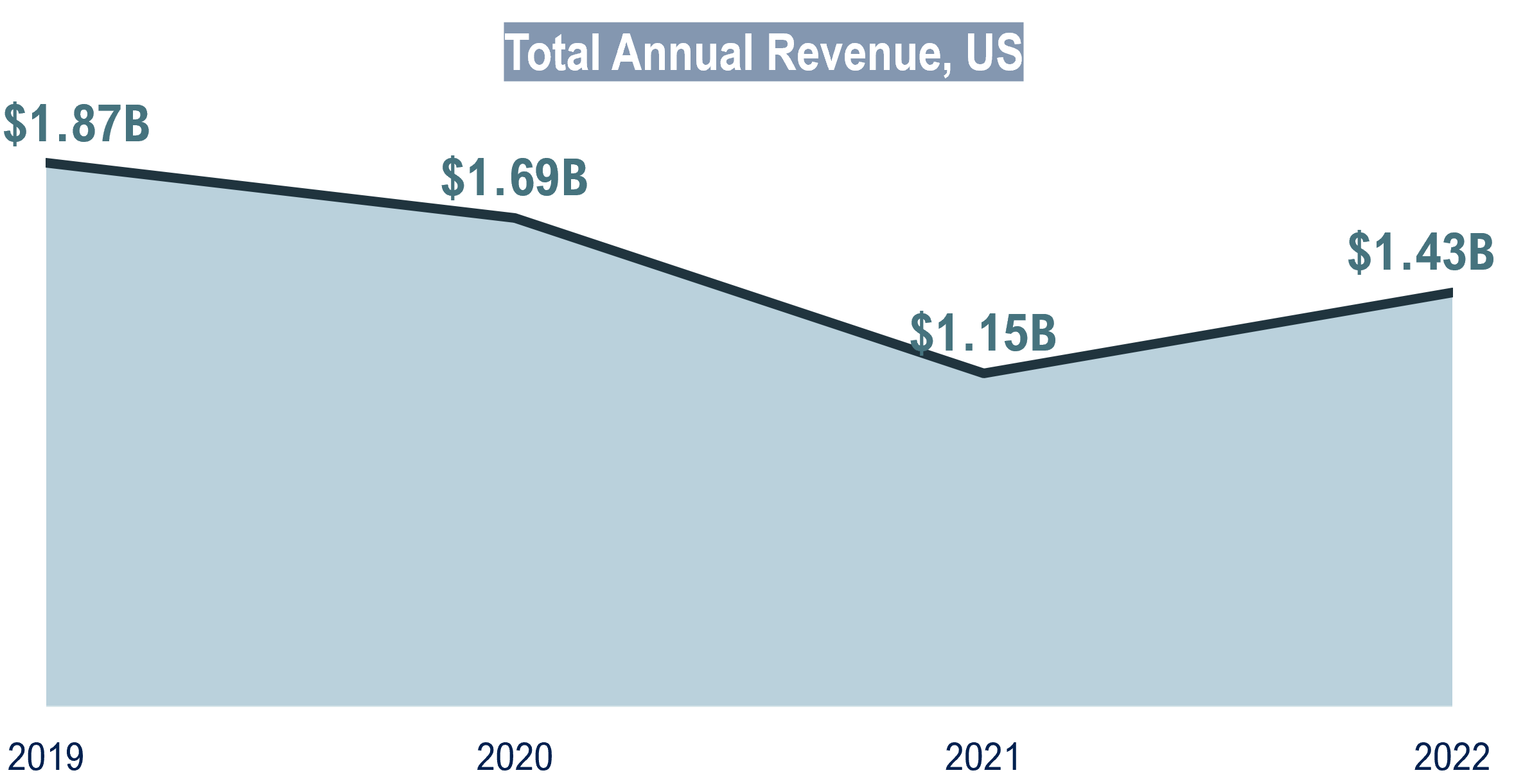

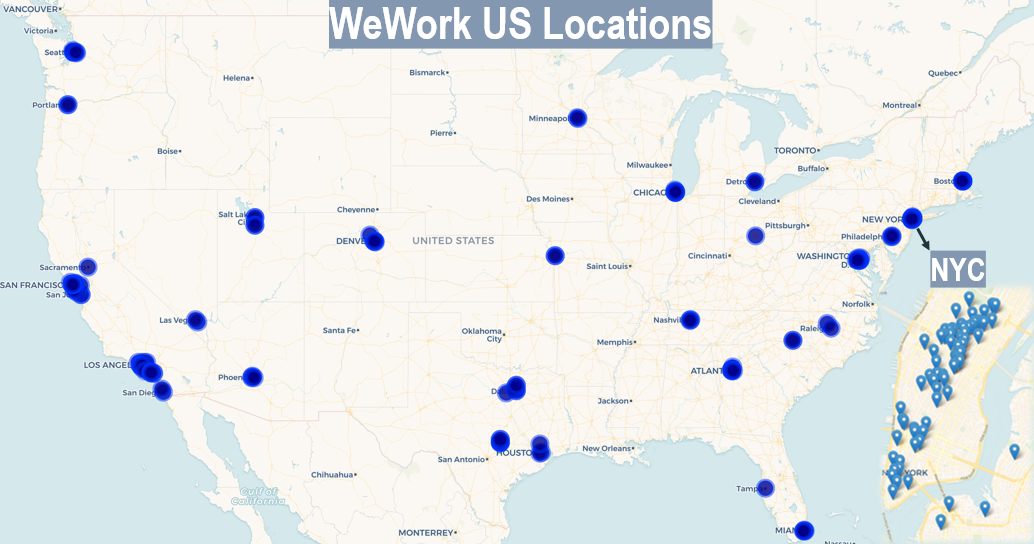

We’re going to focus specifically on the US market (~30% of locations / 45% of revenue) where locations are wholly-owned and operated by WeWork.

In the United States, we’ve identified 234 locations spread across 32 markets generating ~$1.43B in sales.

WeWork makes money from:

Memberships (primary source): Dedicated Office Space, All Access

Services: Enterprise Solutions & Partnerships

Other: Value-Add Upsells, Daily Rentals

Depending on your time horizon, revenue is either up or down. Revenue grew between 2021 and 2022, but was down from 2020.

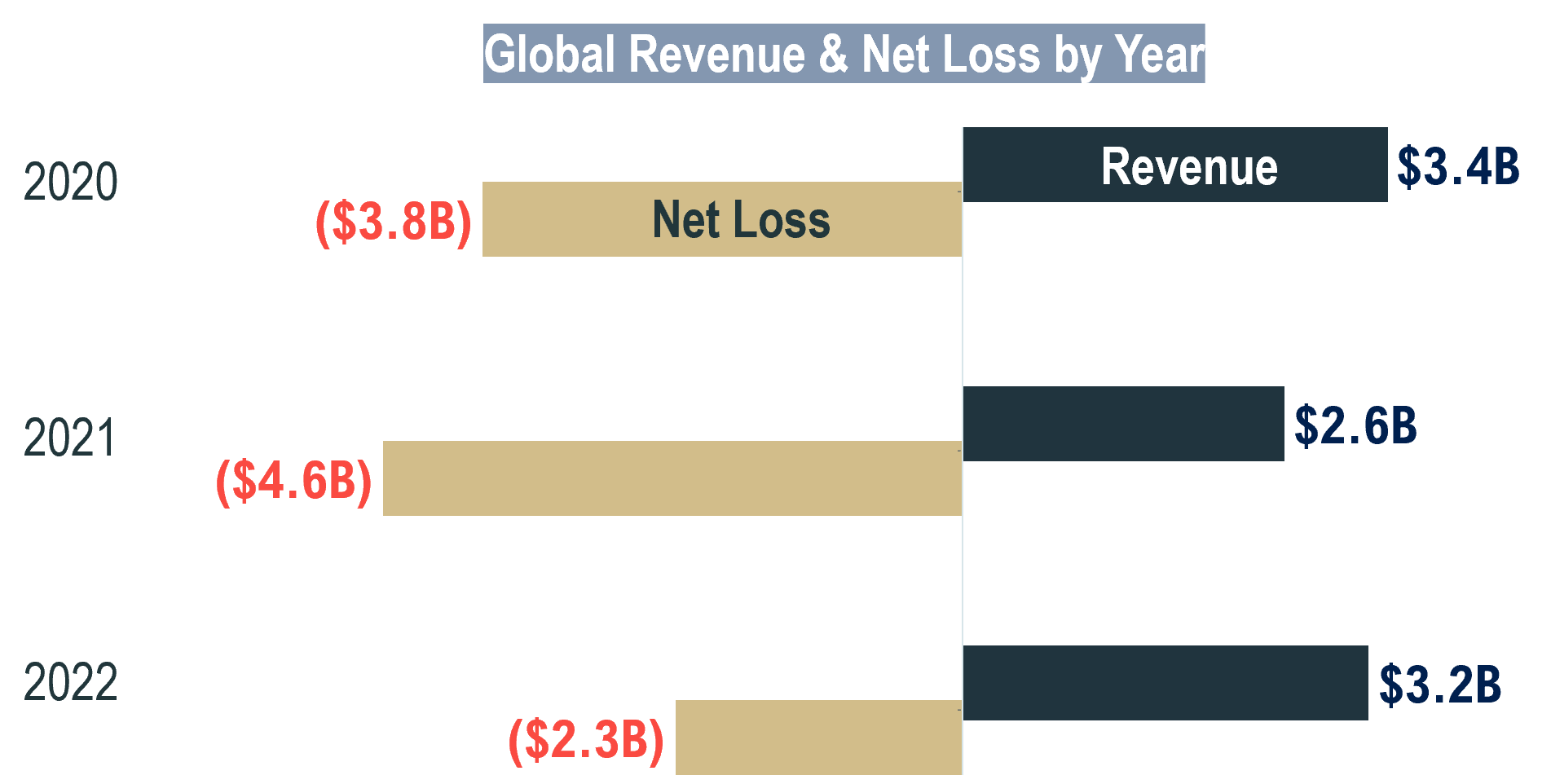

Source: Company materials

Revenue is fluctuating but isn’t the real problem with the business. The problem is that the company spends (a lot) more money than it takes in. Globally, the company lost $2.3B on $3.2B in revenue in 2022, an improvement from 2021.

In 2021, the company lost $1.77 for every dollar in revenue.

Source: Company materials

Admittedly, the last few years have been challenging for commercial office operators everywhere, but the trend is not new for WeWork. It is the result of a decade of bad business decisions, bad personnel, and bad unit economics (read much, much more at the book referenced above).

The company is still recovering from those decisions with the stock at an all-time low of 35 cents as of writing.

Where WeWork Works

Things turned a bit negative working down the path of WeWork’s revenue and profitability, but those mask the positives of the business:

The locations are top notch work spaces

The location planning is meticulous

The go-forward trends are positive

WeWork works in locations that are very urban — the densest places in the largest metros across the country (and world).

Historically, its target market has been startups, young professionals, and ambitious city dwellers. Given this, we’d expect the location profile to skew toward places with high employment and population density.

The analytics can tell us how high and put numbers behind their location strategy.

We looked at the data within a 1.5 mile radius from every location — a radius that represents the immediate reach.

Representative 1.5 mile radius around locations in Miami, FL

Given New York City’s outsize location count, we separated it from the remaining locations.

The data shows that the area around a typical WeWork has:

100,000+ jobs

60,000+ residential population

5–10% 5-yr population growth

$100,000+ household income

Median values based on an analysis of the stated catchment area for WeWork locations

These metrics reinforce their upscale urban target market. To succeed, they need areas with extremely high density — people, workers, business travelers — and to be in places with people or businesses that want, and can afford, a premium workspace.

WeWork knows their target market, finds them, and creates high density in those areas.

The company’s location footprint is a blueprint for any business trying to reach urban office workers in large and growing metros (like sweetgreen, Peloton, and OneMedical).

Diverging Industry Trends

WeWork presents a fascinating case study from a business & industry trends lens. Both of the below are equally true:

Their entire business model built around short-term leases was exposed as a result of COVID

WeWork offers businesses the flexibility they crave during uncertain economic times and enables cost-effective hybrid work

WeWork’s average lease duration is down to 19 months — far lower than traditional commercial office leases. Its All Access passes are month-to-month.

For all intents and purposes, people and businesses can come and go as they please.

To oversimplify, WeWork only makes money if it re-rents the space for more than it leases the space. On a per-building basis, it has a largely fixed cost and variable income.

When times were bad, people let short-term leases lapse and canceled memberships. This can be seen in the fact that the world closed down in 2020 but revenue didn’t see a sharp drop until 2021 — shortly after businesses realized employees would be remote longer than expected.

The rebound in 2022 was material, but still below 2020 levels.

When people could leave, they did, and only some came back

Now, businesses are sub-leasing their office space, downsizing their footprint, and generally looking at how to be efficient with their real estate spend given a rise in remote and hybrid work. WeWork is a solution to these problems.

With flexible lease terms, furnished spaces, adaptable membership levels, and the ability to scale up or down as needed, its a hand-in-glove fit with what small-to-midsize businesses need right now.

It’s well positioned to capitalize on macro trends like:

Fully remote employees that want a physical workspace

A company setting up satellite offices away from a headquarters

Businesses not prepared to commit to a long-term lease

Just as Peloton had its moment when the world went digital, WeWork may have its moment as companies look for Class A workspaces with flexible terms to ride out the economic and workforce uncertainty

Looking Ahead

The challenge of being a real estate company is that revenue is capped at occupancy. Reach 100% occupancy and you’ve largely maxed out your revenue potential until you open or acquire the next site.

As both a real estate and services company, WeWork’s primary revenue levers are:

Price

Location count

Occupancy

Upsell services

The price is largely set by the market and is unlikely to significantly change. New locations are difficult to find, costly to set up, and take time.

This leaves occupancy and upsell.

How can WeWork keep members longer, acquire new ones, and/or increase revenue per member?

One answer is to increase lease lengths, but that negates one of their core value propositions — flexibility.

Instead, it’s about finding ways to integrate deeper into a business and increase member value while charging for that increased value.

A few ideas for what this could look like include:

Partner with a benefits provider to offer Benefits-as-a-Service for very small companies that’s contingent on an active membership

Increase per-member revenue through add-ons like amenity access (gyms, lounges), overnight protected storage, and other premium amenities

Create a member marketplace to connect those that need business services with members that offer them, charging a listing fee to service providers

I might be just making a wish list for myself, but as an All Access member I would pay to store my non-valuables overnight and as a small business owner I would pay to get in front of other members that actively need our services.

If I lose a business development channel by canceling a membership or I have to find a new set of benefits for employees by moving office spaces, I’m going to think longer and harder about whether it’s the best course of action for my business.

Closing Thoughts

WeWork tried to sell itself as a tech company, but it still looks a lot like a real estate company, just with more short-term risk than a traditional landlord.

On the real estate side, the company has honed in on its target market and built a highly effective location footprint that reflects this.

On the business side, though, there’s still work to be done to build a sustainable business model and prove its viability as a public company.

Interested in this topic? Get in touch with me here or by email at jordan@jordanbean.com.