Acquisition Intelligence: Darden’s Acquisition of Ruth’s Chris

Darden Today

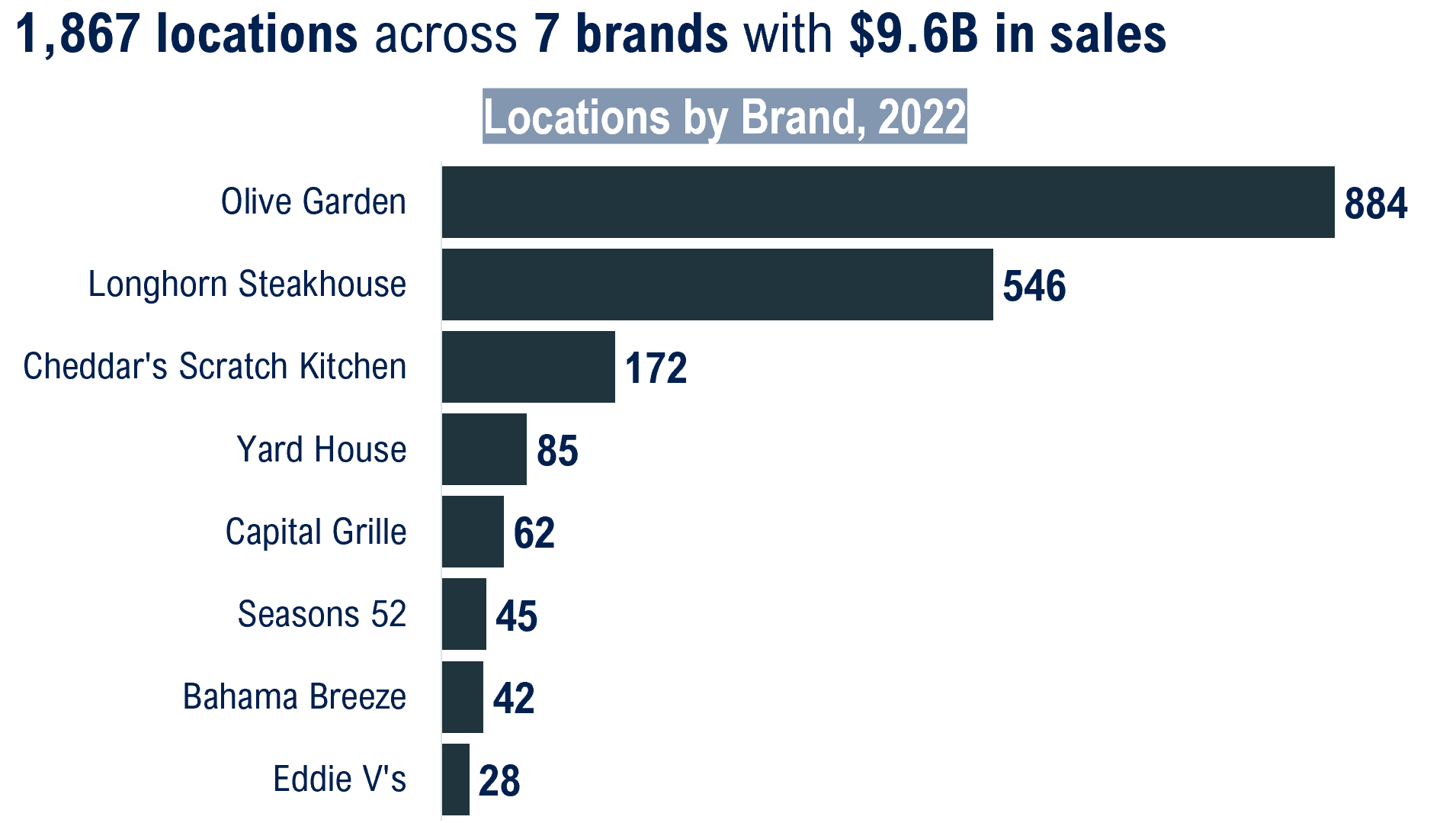

Darden is a portfolio of 7 restaurant brands, almost 1,900 locations, and just under $10B in revenue. Their most well-known brands are Olive Garden and Longhorn Steakhouse.

Source: Company materials as of the end of year 2022.

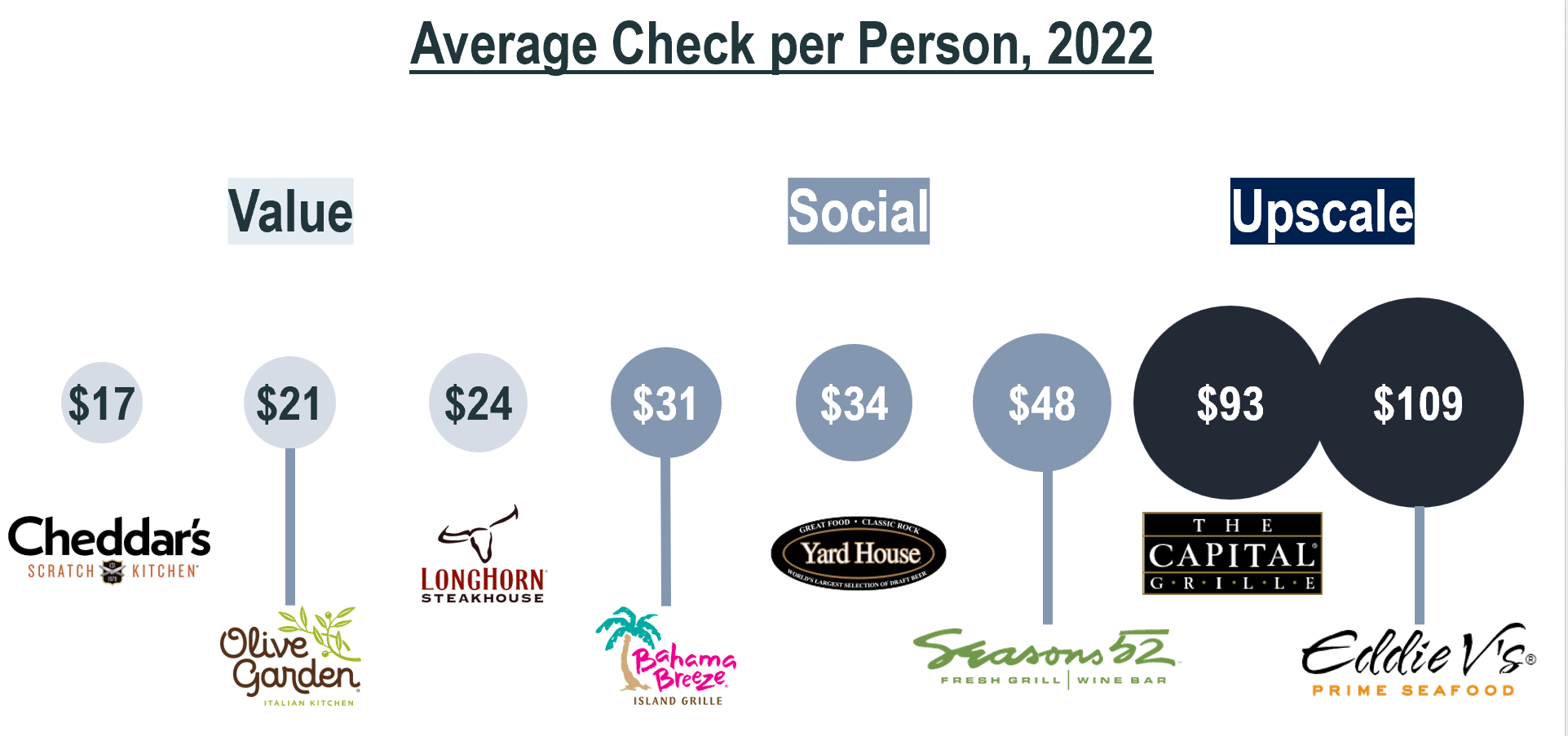

The portfolio of brands touches a variety of customer segments and price points. We’ve segmented them into three areas:

Value: Price points that serve middle-class families

Social: Meetup-oriented venues with higher alcohol sales

Upscale: Premium, luxury steakhouse and food experiences

The average check size per person in the Value brands are around $20, for Social are between $30-$50, and for Upscale are $90-$110.

Source: Company materials as of the end of year 2022.

Based on the customer segment and brand positioning, we see varying site selection criteria for how the brand thinks about an area that “works” for the restaurant.

Brands that are Upscale have:

Larger trade areas

Higher surrounding population

Higher focus on nearby wealth & business travel

Conversely, the site selection criteria for Value brands focuses less on market size and more on convenience with an emphasis on the average daily traffic passing by a location.

Source: Company-published site selection criteria

The important point to note here is that there’s limited growth runway for Upscale brands that have a higher threshold for site selection.

A Value brand can find success in more communities than an Upscale brand — this is one reason why Olive Garden has 884 locations and the Capital Grille has only 62.

There are only so many communities with high-income, large market size, high hotel density, strong employment…and so on. Of the communities that fit this profile, the brand and/or competitors have likely already opened there.

Which leads us to…

Darden + Ruth’s Chris

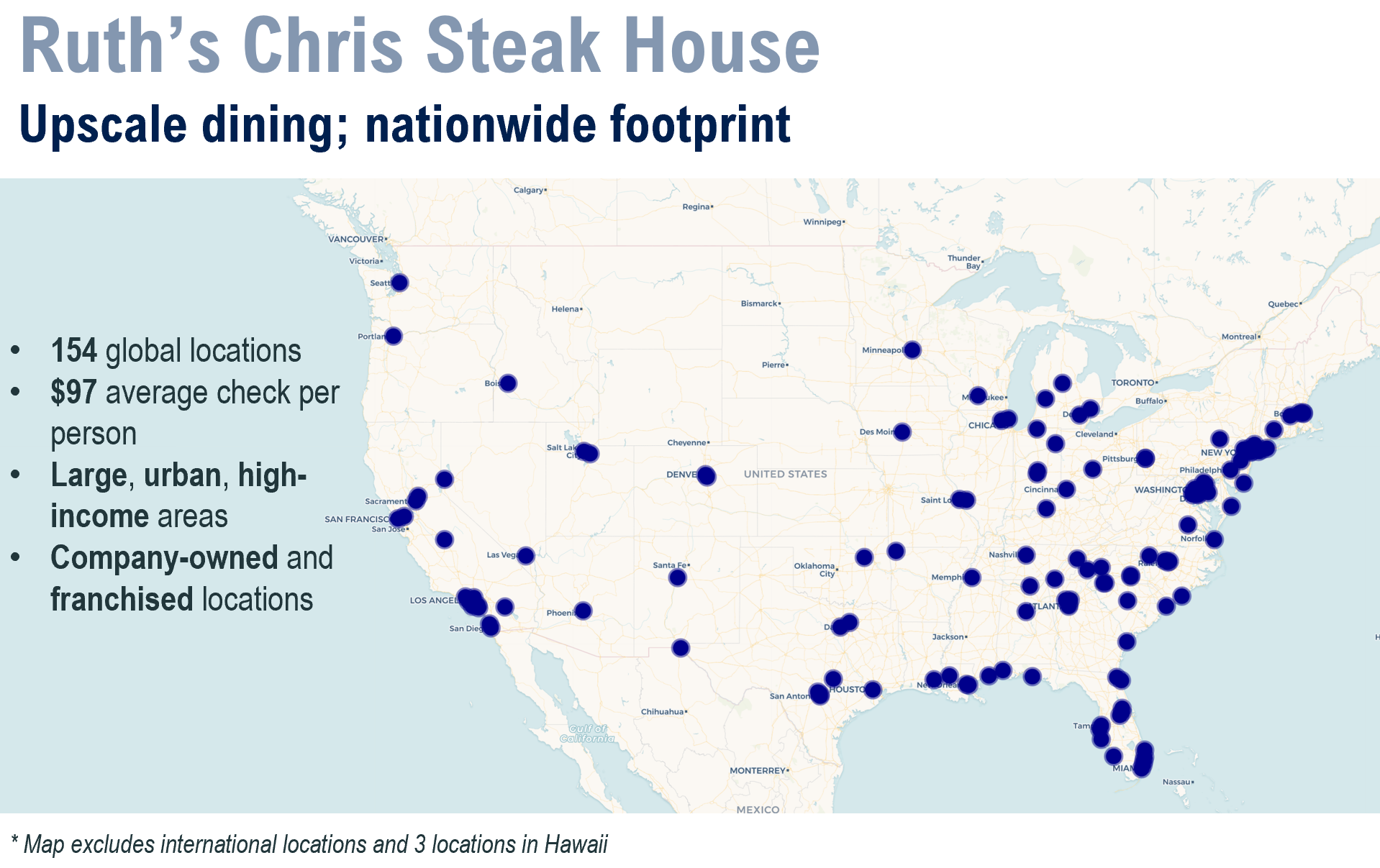

Ruth’s Chris Hospitality Group - owner of Ruth’s Chris Steak House - operates 154 global locations through primarily company-owned and franchised arrangements.

The US locations - the focus of our analysis - are scattered across the country and tie to major metro hubs.

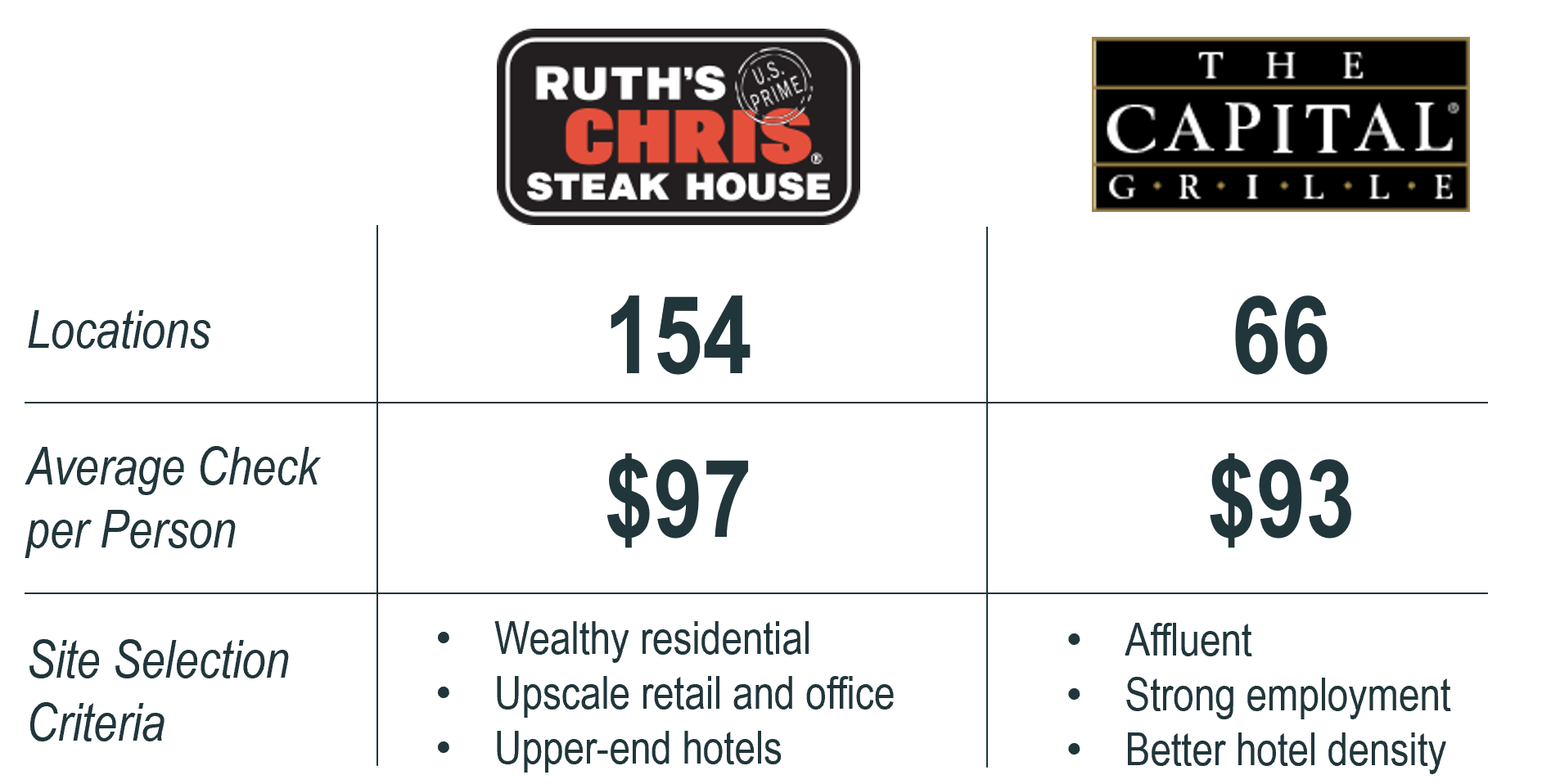

Ruth’s Chris is a direct competitor of Darden’s Capital Grille brand. Considering the two side-by-side, we see effectively the same average check size per person and site selection criteria.

The biggest differences are the number of locations and geographic footprint of those locations.

Ruth’s Chris has nearly 100 more active locations than the Capital Grille. In addition to having a much larger footprint outside of the US - in particular in Asia - Ruth’s Chris also has more locations in the Midwest, Southeast, and West coast.

In the image below, we’ve overlaid the two brands. Red circles are Capital Grille locations and Blue circles are Ruth’s Chris.

Areas with both Red and Blue are places where both brands operate, while blue alone are places where Ruth’s Chris alone operates.

Look specifically at places like California, the Midwest (ex-Chicago) and the Southeast (the Carolinas, Louisiana-Alabama, and Georgia) to see how there are many more Blue dots than Red.

Ruth’s Chris (blue circles) and Capital Grille (red circles) locations in the United States.

We ran the numbers to see how much overlap there was between Capital Grille and Ruth’s Chris locations focusing on US locations.

Of Ruth’s Chris’ 135 US locations, we found that the brands compete head-to-head in ~20% of locations, are in similar areas for another ~20%, and ~60% of Ruth’s Chris’ locations are materially new areas compared to the Capital Grille.

By the numbers:

13% of Ruth’s Chris US locations are less than half a mile from the closest Capital Grille

9% are between 0.5-2.5 miles

21% are between 2.5-10 miles

15% are between 10-50 miles

42% are more than 50 miles from the closest Capital Grille

Source: Analysis of company locations in the United States

Consider the below tangible example of what this looks like near Washington DC. The Capital Grille (red circles) has 5 locations in the pictured area. Ruth’s Chris (blue circles) has 14.

Red circles are current Capital Grille locations. Blue circles are Ruth’s Chris locations.

Ruth’s Chris moves Darden into 4 net new markets - Atlantic City, NJ, Ocean City, MD, Richmond, VA, and Virginia Beach, VA - in addition to in-filling the space between Baltimore and DC.

Combined, Darden now has 19 locations in the pictured area. This type of location growth might’ve taken a decade or more to do organically (more on that soon).

The Value of the Acquisition

Ruth’s Chris has several attractive traits to Darden, including:

Enabling new market expansion

The value of current sites

A global brand

Enabling New Market Expansion & Value of Current Sites

New market expansion is costly, time-consuming, and risky.

How do you decide which markets to enter? How long does it take to find the right site in the right neighborhood? How do you build a local following and support?

For upscale brands, these questions are further complicated by the constraints put on the search process.

The market can’t just be large, it has to be large and wealthy. The location can’t just be right, the building has to have the right aura for a premium brand.

The buildings for a premium steakhouse need to be stately, on the right streets, surrounded by the right businesses, and near the right complementary amenities (upscale hotels, convention centers, white collar offices, etc.).

An acquisition of an overlapping brand effectively eliminates the above constraints.

We estimated that 42% of Ruth’s Chris US locations were more than 50-miles from the closest Capital Grille. This equates to ~57 brand new markets for Darden’s upscale steakhouse brands.

This is a similar strategy Cava’s acquisition of Zoës Kitchen where Cava made the acquisition for the underlying real estate assets.

Site and market selection is hard. Acquisitions of like-minded brands makes it easier.

A Global Brand

The Capital Grille has just a handful of international locations, all focused near US operations.

Ruth’s Chris operates a global brand with locations in China, Taiwan, Japan, Singapore, the Philippines, and Indonesia, among others.

Their expertise in international operations, franchising, and developing a global brand will likely be of value to the Darden and Capital Grille teams. This gives Darden a head start in nearby markets like Canada and Mexico along with further away markets like Asia.

Closing Thoughts

Acquisitions take many forms. Some buy out competitors, some add top line revenue, and others have strategic synergies.

This acquisition has value in expanding Darden’s Fine Dining brand, improving geographic coverage for its upscale steakhouse brand through immediate location growth, and expertise in new international growth avenues.

Interested in this topic? Get in touch with me here or by email at jordan@jordanbean.com.