Expansion Strategy: Not Sure Where to Expand? Find your Copycat Brand

I see and work with brands that are successful in their home market but not sure where to take the business next. Of the many expansion markets available, where do they invest for growth and why?

This question is complex, but there are market cues that can make it easier. One that I encourage businesses to use is the “brand copycat” approach.

I often hear business say something like “We want to be near a Target”. This is the idea of a brand copycat.

The Idea

The premise is fairly straightforward: Large and successful brands spend significant resources on identifying the markets and neighborhoods that can work for their business. Small and midsize brands without the research resources of these large brands can benefit from this.

Find a brand with a similar target market and you have a head start on finding an area that might work for your business.

The brand doesn’t need to be in your industry (and sometimes its better when they’re not), it just has to have a similar target market and audience (think: Target & Starbucks).

It’s best used in the early stages of developing an expansion strategy to get a head start on the regions to be researching in your search area. Chances are if a brand targeting a similar target customer has decided to operate in the region, it could work for your business.

It’s Not just for Retail Stores

Another common misnomer is that this approach is only for brands with a physical location - it’s not. This strategy also benefits companies in industries like home services or direct-to-consumer products.

For example, a company that sells a locally delivered subscription product with a target market of suburban households and above average income might be well served to look at markets where a brand like Target has high store density.

Examples

We’ve spent significant time looking at expansion markets and researching brands. We’ve shared a couple examples of representative market segments below for the brand copycat approach:

Active, Urban, High-Income Millennials: Peloton operates ~90 retail stores geared at heavily urban areas with income well above average. The salad chain sweetgreen has 200 locations and isolating their urban markets & neighborhoods will show areas with health-conscious, high-income consumers.

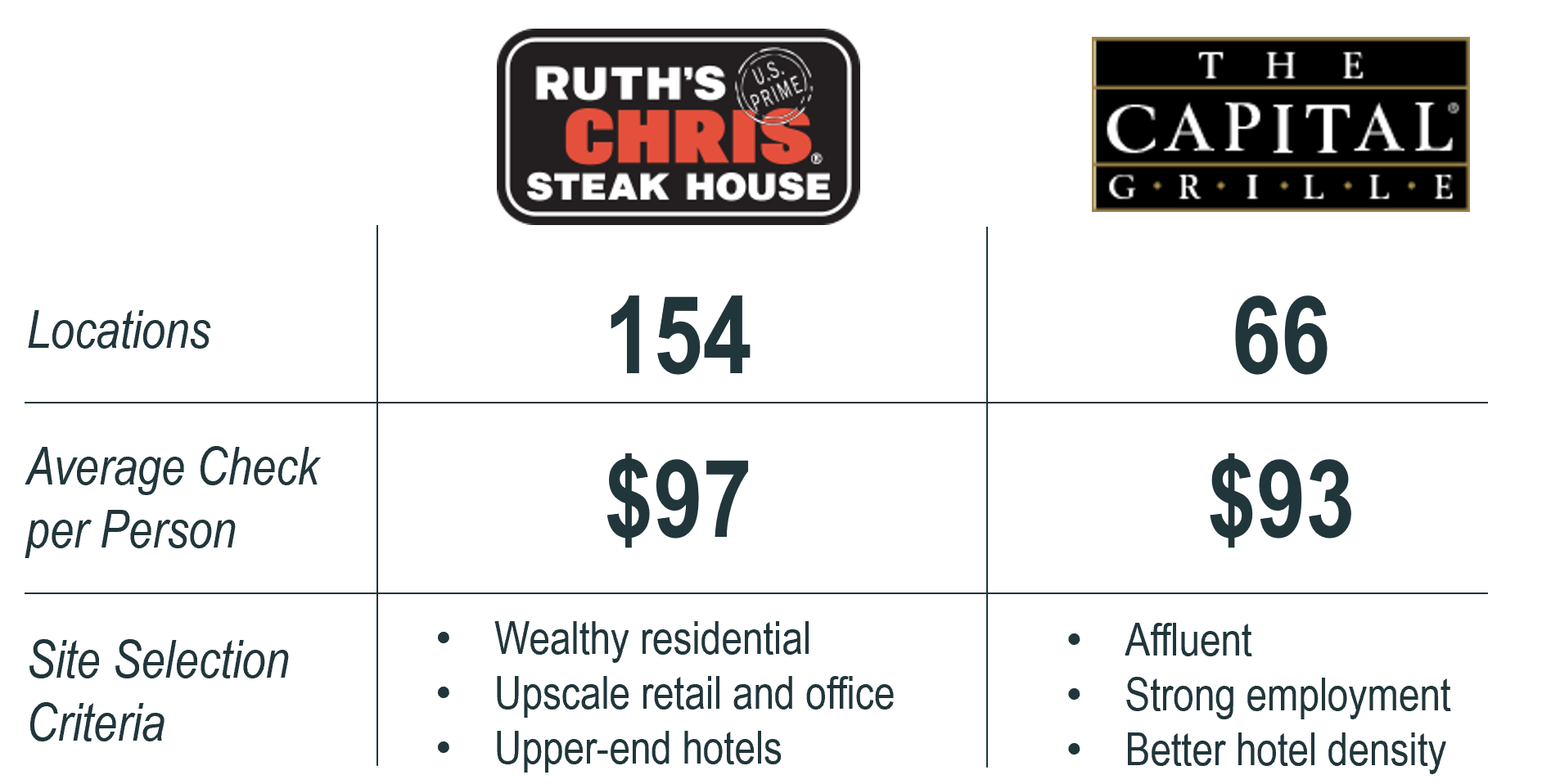

High Income, Business-Oriented Areas: You may find success looking into areas with upscale steakhouses, places like Ruth’s Chris or Capital Grille. Their average check size is almost $100 per person and in our research we found they target large, affluent trade areas with high hotel and employment density.

Young, Large Workforce, Urban: WeWork has 234 US locations that are mostly urban and in areas with very high surrounding workforce (after all, they operate high-end office space). The areas around their locations are fast-growing, high-income, large population, and well educated.

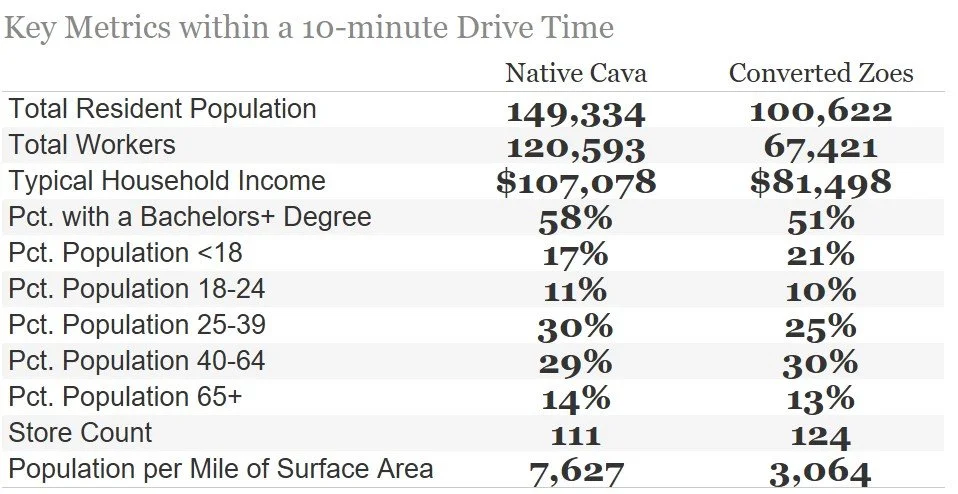

Fast-Growing Suburban: Cava acquired Zoës Kitchen for the value of its suburban store footprint and started converting its stores to the Cava brand post-acquisition. Markets that had a Zoës were well-educated, above average income, and suburban, though still with high market size.

Mass Market: Want to be everywhere? Take a look at someone like Chipotle. They’ve saturated urban and suburban markets with locations.

High-Income Suburban: Looking to reach a wealthier suburban customer? Look at the areas around where Apple operates. These locations have extremely high reach (we estimate about 25% of the US population across just ~250 locations) in select urban and high-impact suburban areas.

Large Suburban and/or Emerging Areas: Look at the area around a Costco. Given the size of store footprint, they typically operate outside of - but on the outskirts - of urban areas. We’ve also seen them growing in up-and-coming fast-growing suburban areas.

Starting Point, not the Finish Line

Finding a copycat brand gives you a head start on where to think about expansion. It doesn’t answer the question about where to expand, but it provides a set of high-priority markets to begin the search.

These markets and areas have been “pre-vetted” and a business can now overlay its own strategy & goals to prioritize from this starting point.

The method goes beyond traditional competitive intelligence. It shifts the perspective from an industry-centric approach to a customer-centric approach. Where does your target customer live, work, and spend time? How can you get as close to those areas as possible?

The most important place to start is identifying your target market characteristics. Does your business work in areas that are urban, suburban, or rural? Is your typical customer high-income, middle-class, or lower income? What other characteristics can you use to describe your target market?

From there, it’s about defining the search region, finding your copycat brand, and finally identifying where they are today.

Interested in this topic? Get in touch with me here or by email at jordan@jordanbean.com.