Where People are Moving and What it Means for Businesses

Many changes have arisen over the past few years, and one of note has been the change in migration patterns - how often and where people move. As with many things, this is something we can look for in data.

Where were people migrating before and where are they migrating now?

Some research shows that, on a percentage basis, Americans are moving less often than before. However, even if true, where and why people are moving has changed, and the changes have implications for the businesses serving these households.

We analyzed IRS tax filing data from 2018-2021 to understand where households were leaving, going, and how income was shifting between areas.

Before:

Brands looking to capitalize on urban hubs benefitted from building density in stable, high in-migration places like NYC, Boston, and San Francisco.

Now:

Brands are looking toward suburbs and emerging regions — like the Sunbelt — to follow customers and find new areas for growth.

3 Key Findings

High cost of living coastal areas lost more residents out-of-state in the first year of COVID than prior years

Texas, Florida, and the Carolinas benefited greatly from in-migration of out-of-state movers, oftentimes bringing higher income than current residents.

Businesses that traditionally served coastal urban areas can benefit from emerging suburban and Sunbelt communities.

Where People Are Leaving & Moving

To get a representative view of true movement and migration, we looked specifically at households that moved and left their state of origin between the 2019 calendar year and 2020 calendar year. In other words, a move from Boston to the suburbs of Boston would not be included, but a move from Boston to New Hampshire would.

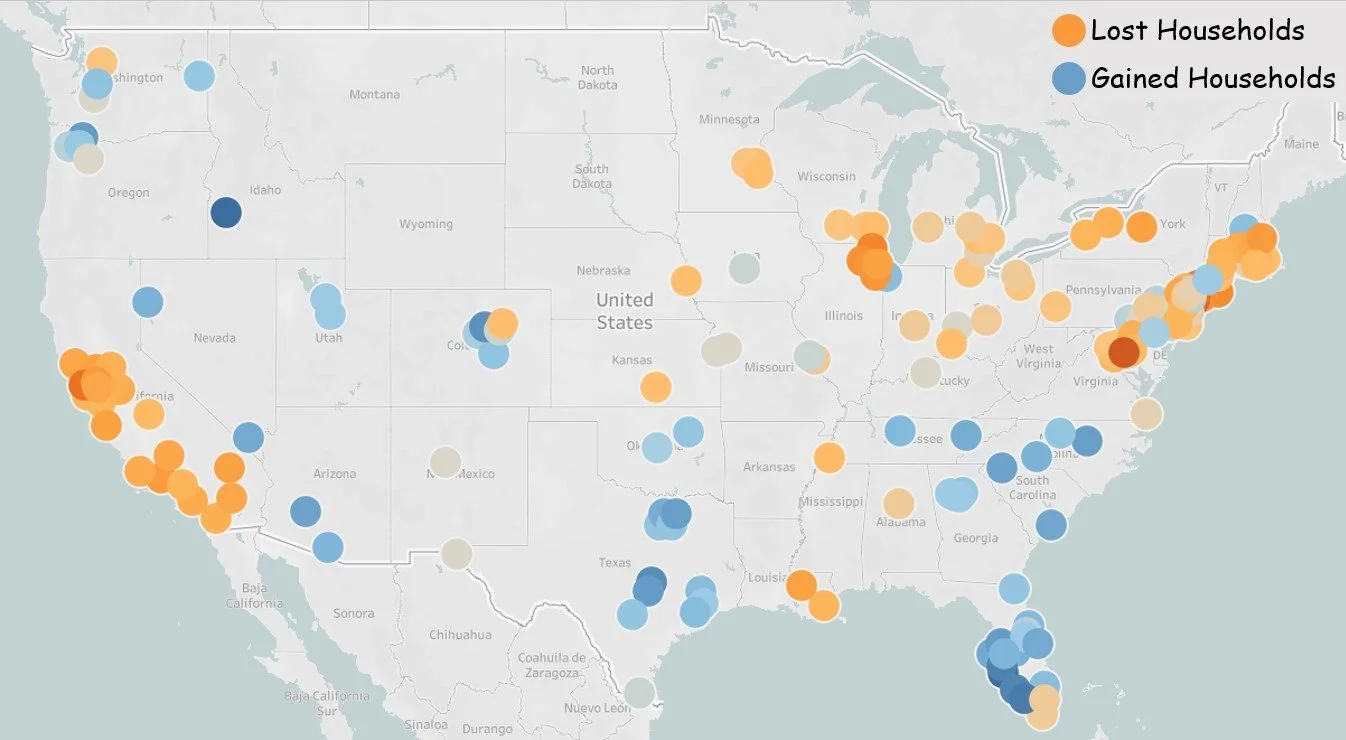

The below chart shows the net change in households based on out-of-state movers for counties with more than 150,000 households.

Percentage change in households (incoming households minus outgoing) by number of returns filed for households that changed states, 2019-2020.

The Sunbelt was a hot destination for households that moved states between 2019 and 2020:

Large counties in Texas, the Carolinas, Tennessee, Georgia, and Florida all saw strong in-migration (more households moved in from out-of-state than left the state)

Up and down California, more movers were leaving the state than moving in

In the Northeast and Midwest most communities saw more outflow of residents to other states than inflow.

*This analysis excludes in-state migration.

New York and Florida specifically were on opposite ends of incoming and outgoing households.

The net change of (3.9%) in New York County in the chart means that, if there were 100 households in New York County in 2019, there was 96 in 2020 after considering only households that moved into the county from out of state or left the county and moved to another state.

In fact, a lot of households were leaving greater New York City, even when adjusting for its larger population size. 4 of the top 5 worst counties for net out-of-state change were NYC and its surrounding counties.

Southern Florida benefited from these migration trends. In just one calendar year, some counties, especially in southwest Florida, had a net gain of about 3% in total households based on in- and out-of-state migration.

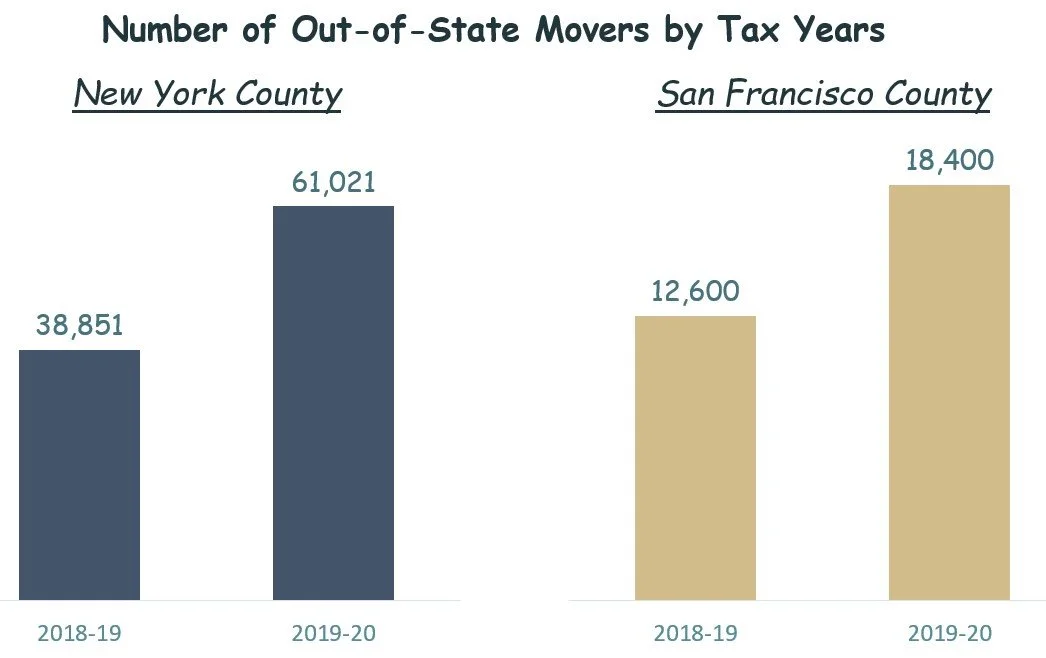

In places like New York City and San Francisco, the rate of people leaving accelerated. In Suffolk County, MA (home to Boston) - and NYC - the incomes of households moving out-of-state was increasing.

New York County:

2018-2019: ~39K households move out of state

$183K average AGI (Adjusted Gross Income)

2019-20: ~61K households (+56%)

$214K average AGI

San Francisco County:

2018-2019:

~12.6K households move out of state

2019-20:

~18.4K households (+46%)

Suffolk County, MA (Boston):

2018-2019:

Average AGI of $100K for our-of-state movers

2019-20:

$115K average out-of-state moving AGI (+15%)

Changing Income Patterns

Areas with a high positive net change in households from out of state also generally had higher income households moving in.

7 of the top 10 states by positive net household change had higher income for households moving in than those already living in the county, including all of the top 5.

The effects of these migration shifts are largely felt by the housing market in the short-term. Home prices in Florida skyrocketed during the early pandemic, and these numbers put some data behind the “why”.

Taking Lee County as an example - historically considered more of a retirement community in southwestern Florida - the median sale price for a home increased from $230K in January 2019 to $357K by the end of 2021, according to data from Redfin.

This represents an increase of ~55%, and the average incoming AGI was about 77% higher from the chart above. While not a one-to-one relationship, it’s likely safe to assume that there’s a correlation between more income and the higher prices.

Implications for Business

Coastal urban hubs remain large and attractive markets for businesses with that target market.

However, they’re no longer the only place to reach the market.

Households that move bring their hobbies, food preferences, and lifestyles to new areas and increase the size of markets that previously might have been too small.

Markets like Nashville, Raleigh NC, Charlotte NC, and Denver CO may have previously been considered secondary markets, but these now represent strong up-and-coming areas.

More households means both a need for more essential services and nice-to-have services.

Healthcare professionals like doctors and dentists can benefit from more favorable patient-to-provider ratios as households move in. Restaurants - particularly the fast casual industry that target working professionals - may also find these to be lucrative markets given the relatively lower competition and lower cost of real estate.

Return to office rates increasing will test which markets have long-term durability and which experienced short-term swings. We look for markets that are self-sustaining through local employment opportunities to complement remote workers as one indicator of where to invest for growth.

Markets that have been historically reliant on tourism or “snowbirds” may struggle to maintain momentum - places like Boise, ID or many Florida metros. Areas that have the commercial infrastructure, local companies, and early career talent pipeline may be longer-lasting growth markets - places like Raleigh, NC, Denver, CO, and Austin, TX.