Acquisition Intelligence: Amazon’s Acquisition of OneMedical

In late July, Amazon announced its ~$4B acquisition of OneMedical, a provider of primary care services throughout the country. This is a major step forward for Amazon into healthcare. Healthcare is one of the few markets where (1) Amazon has a limited presence today (2) there’s a massive market size and (3) there is significant opportunity for improvement. Amazon had $470B in 2021 revenue, so any decision must meet these criteria as even a company generating $4B in revenue — more than nearly every company in the country — would only be a <1% lift.

This isn’t Amazon’s first entrance into the healthcare field. Amazon Pharmacy handles delivery of medications and a couple years back Amazon partnered with JPMorgan and Berkshire Ventures to try and stand up a new way to deliver healthcare for employees, a venture that has since fizzled out.

OneMedical differs from Amazon’s traditional business because it largely comprises of physical locations. This is reminiscent of their Whole Foods acquisition in 2017 — large market, overlapping products but new category, and a physical set of stores.

Amazon can benefit from physical locations by either reaching a new audience or building deeper relationships with their existing customers. How does OneMedical help them achieve this goal? Who does Amazon reach through this acquisition?

OneMedical: A Subscription Healthcare Business

OneMedical provides primary care services at about 130 locations across the US. Unlike most other healthcare providers, OneMedical generates a portion of their revenue through a subscription service (something that Amazon is quite familiar with).

A subscription gets you access to any of their locations (with your health information available to any provider in their locations), 24/7 virtual care, same or next day appointments, on-site lab services, and more, all for $199 per year. In addition to the consumer memberships, OneMedical earns money from providing services to patients (billed to an insurance provider like any other medical office), business partnerships to offer memberships to their employees, and smaller miscellaneous sources.

By the end of their 2021 fiscal year, the company had about 736,000 members, and direct membership revenue represents about 15% of their 2021 revenue.

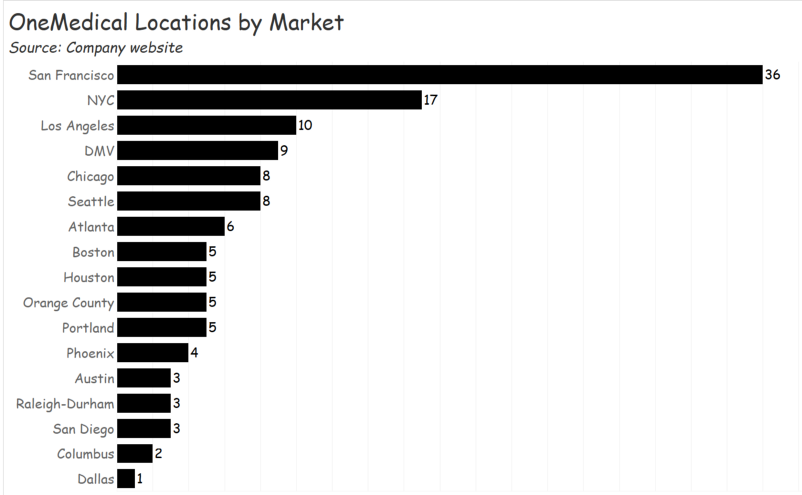

Today, OneMedical’s ~130 locations largely track to many of the most populated metro areas. San Francisco is their biggest market with 36 locations, followed by New York City (17), Los Angeles (10), and DC (9).

Building OneMedical’s Location Profile

Given OneMedical’s choice to locate in larger cities, we’d expect the demographic profile surrounding their locations to look different than the broader US population, and the data confirms this. In the areas surrounding their locations — defined as a 20-minute walking radius — the population is highly educated, high-earning, young, and active.

The typical location has ~20,000 people (10,000 households) living within a 20-minute walk and ~12,000+ jobs located in the radius. These households earn about $116,000 per year (the US median household is ~67,500) and ~55% earn more than $100,000 (the US benchmark is ~34%). Further, about 30% of the jobs in the radius are classified as being high-income. About 35% of the population is between the ages of 25 and 39, compared to about 21% in the broader US.

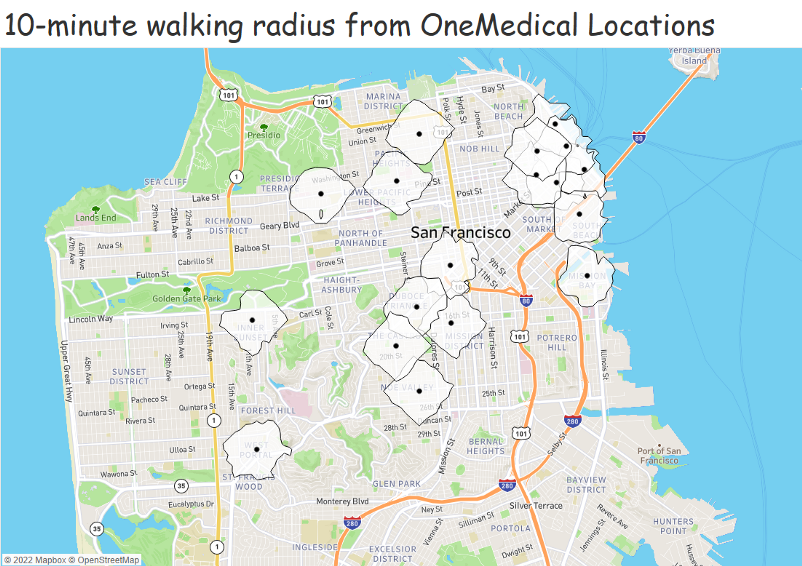

Let’s zoom in a level further and look at some actual locations and how the locations interact with each other to form a location strategy. We’ll start with their largest market, San Francisco.

Plotted together, we can see an interesting relationship. The company gets effectively full coverage of high dense areas within overlapping 10-minute walks. The locations in the top right, middle top, and middle all form rings around different neighborhoods. This allows them to be convenient, accessible, and close to major population and employment centers without too much overlap. In other words, it gives collective coverage area while minimizing customer cannibalization between stores.

Moving outside of walkable areas, we can transition to see how their suburban locations also create a similar boundary around an area, this time through driving. The locations in the area south of San Francisco from their Burlingame location to Palo Alto cover an extensive area within a 10-minute drive.

A similar location pattern plays out in the suburban sprawl of Phoenix. Look at how much coverage the company can get with just 3 locations strategically placed in different areas of the city, then a fourth location away from the cluster. The three locations at the top reach nearly 400,000 people collectively with little overlap between them, all with just a 10-minute driving radius, again highly convenient.

Moving back to a dense section of a major city, Washington DC, we can see how the 10-minute walking radius again creates tremendous value in its positioning of the locations to maximize coverage while minimizing overlap as much as possible.

Having lived in the heart of a walkable city, I can say that these distances may sound small but they’re significant. I picked healthcare providers based on who was somewhere between the 10-minute walk from my office to my home, and I probably wouldn’t have considered something that was a 20-minute walk or further from either of those locations given how many providers there are in these areas.

The above is a long-winded way of saying that OneMedical has figured out a targeted and efficient location strategy to serve dense urban markets and larger suburban markets — the same markets where Amazon likely has their strongest customer base today. Their location selections are strategic and geared toward convenience for the customer, something that has strong overlap with Amazon’s customer-centric philosophy.

Amazon + Whole Foods + OneMedical = ?

In many ways, OneMedical extends the similar location profile of a WholeFoods customers. Whole Foods’ largest market by store count is California. The stores are located in zip codes with high population density and a typical household income above $90,000. Over 95% of their stores are in areas classified as urban, with the remaining 3% suburban.

In zip codes that have a Whole Foods, over 58% of the population age 25+ have a bachelors degree or higher, and about 42% of the population is Millennial or Gen Z. All of these compare favorably to OneMedical’s young, educated, high-income areas.

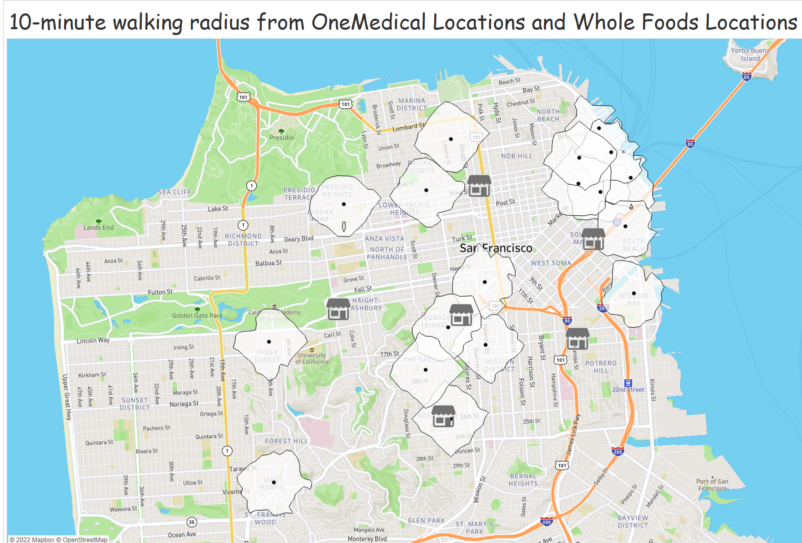

As an example of the overlap in OneMedical and Whole Foods customer bases, we can look again at downtown San Francisco. Of the 6 Whole Foods locations, 4 are within or nearly within a 10-minute walk of a OneMedical location, and all are in or nearly in a 20-minute walk.

Unsurprisingly, there’s also strong overlap with the demographic profile of Amazon’s customers too. Various reports on Amazon customers suggest that their household income is around $85,000, about half have a college degree, and more than 80% of households earning more than $112,000 in income (as of 2017) were Amazon Prime subscribers. They’re also young, with over half of customers between the ages of 19 and 44.

Taken collectively, we can connect the dots and hypothesize that Amazon is targeting a specific customer segment and trying to build a suite of services across different aspects of their life — their entertainment (Prime Video, Kindle, Amazon Music, Fire TV), their weekly grocery trip (Whole Foods), their annual or ad-hoc visits to the doctor (OneMedical), their recurring prescriptions (Amazon Pharmacy), their retail shopping (Amazon Prime, Amazon Go), and perhaps someday soon financial services (early tests with Amazon Cash, Amazon Branded Credit Card).

What’s Next?

It seems highly unlikely that there would be any type of combination of the OneMedical and Amazon Prime subscription services despite the overlapping customer base. The complications of navigating HIPAA data compliance and how it might be combined with a consumer purchase data just isn’t feasible.

Likewise, I’m not sure if there could be significant cross-marketing between OneMedical and Whole Foods. People that buy healthier food may have better health outcomes, but Amazon Prime members already get a discount at Whole Foods, and there doesn’t appear to be significant additional value-add there to push OneMedical customers toward Whole Foods.

The biggest immediate gain is a credible brand name in the primary care field, access to almost 750,000 subscribers, and access to the business partnerships that underlie the commercial side of OneMedical’s business. Although their initial partnership with JPMorgan and Berkshire Ventures fizzled out, that doesn’t mean their ambitions to deliver better healthcare offerings did too.

This acquisition provides them with a brand, way to deliver care, and expansion platform to build a healthcare arm of their business. Perhaps it may even be used as a way to lower their own healthcare costs as it relates to providing employees with affordable and accessible healthcare options. Just as Apple is differentiating from its iPhone revenue with its Services segment, Amazon may be diversifying its revenue potential with a new market opportunity, albeit a small contributor today.

There’s ample opportunity to continue to grow OneMedical in new and existing markets. The New York City metro area has 5x the population of San Francisco, but less than half of locations by count. Two of the top 10 largest metros by population don’t have a location (Philadelphia and Miami, though Miami is coming soon) and others like Dallas (4th largest metro) has only 1 location currently.

Given its size and scale, anything Amazon does gets attention. Today, this is small in the bigger picture of their business, but no doubt the ambitions and goals are large to grow OneMedical into a premier healthcare brand while continuing to grow the reach of Amazon into different aspects of an everyday American’s life.