How We Find New Geographic Markets for Growing Businesses

Few decisions — other than opening the doors in the first place — are more difficult and riskier for small to midsize businesses than expanding their business. You’ve built a successful business at a location or serving a single market, and you’re ready to take the next step. Which market should you enter? Where should you look for property? Where should you focus your time and attention?

Taking this leap is risky, but bringing data and analytics to the conversation helps bring more conviction to the decision-making process. We believe that data, combined with a business’ knowledge of their industry and customer, leads to the best decisions. We break down the process to find new markets into 3 discrete steps: Diagnose, Research, Prioritize.

Diagnose

During the first phase, we want to learn more about what drives success for the business. How can we put numbers behind the customers that use the service or the markets where the company has a presence today? What needs to be in place for the company to succeed?

As an example, let’s imagine you were a dental group focused on pediatric services. A couple of the data points that might be important to you are the percentage of households with children, proximity to K-12 schools, the percentage of homes that are owner occupied, and population growth. On the other hand, if you were opening a new coworking space, you might want proximity to other jobs and offices, access to main highways or commuting roads, a large working age population, and a high percentage of the population working in office-related jobs. We take our — and your — knowledge of the business, then source and analyze the relevant data points to see which drive success.

This analysis can take many forms. For businesses that offer services with home delivery, we can leverage address information to create core customer profiles. We’ll look for the bright spots - Which areas have high concentration of customers? - and build a profile for those areas. Which data characteristics distinctly describe those areas? We’re looking for differences between those areas and broader benchmarks. Is there higher population density? Higher percentage of millennials? Higher or lower income? Anytime we see a difference, we can infer that the data point may be telling us something about the type of customer that uses the service. If we see higher income and a higher percentage of millennial-aged population in areas with more customer concentration, we can hypothesize that the business has better success with that demographic, and it’s something we should look for in future market searches.

These customer concentration profiles can also lead to new insights in current markets - are there areas that have your target customer but where you don’t have a significant presence? If yes, why? Is this an opportunity for growth in current markets?

Example of how we view “point” data like addresses, where we look for areas with higher density (darker blue) then create demographic profiles of those areas.

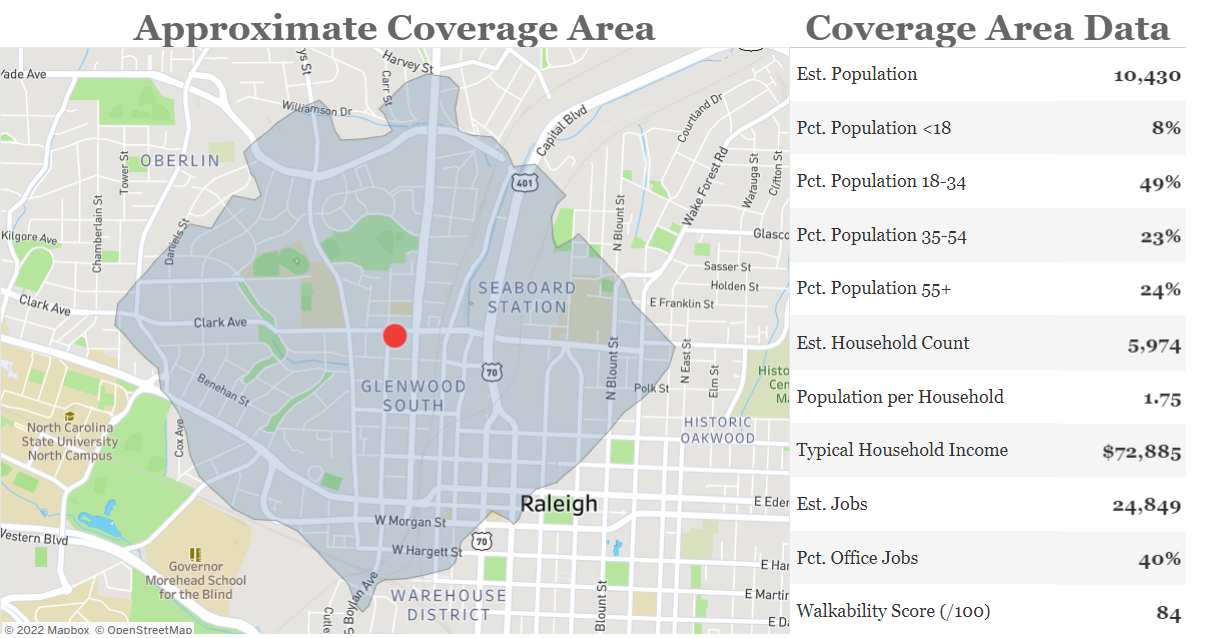

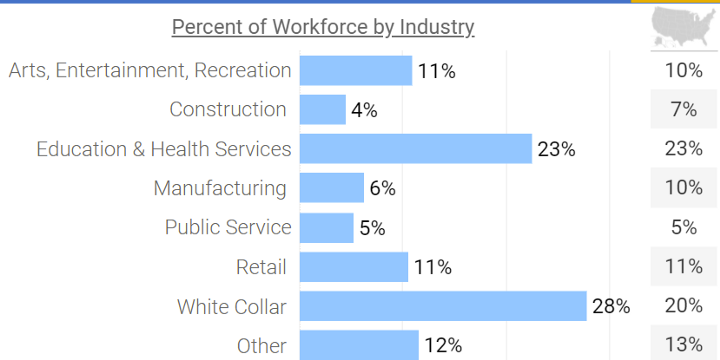

If the business has a physical store footprint, we’ll look at the data surrounding the location(s) - How many people live nearby? What is the age distribution? What is the typical household income? Which other types of businesses locate nearby? We’ll turn this into a profile to benchmark for future locations.

Example data points in a 10-minute walking radius from a location.

For companies that service markets rather than a physical address, like a city, county, or metro area, we’ll build benchmarks to help in future research. What is the market’s size? Level of household income? We look for characteristics relevant to the business’ success, then put the data and numbers behind them to inform the next steps.

The output of the Diagnose phase is a set of criteria that guide our new market searches. It allows us to understand with whom, or in which types of areas, the product or service is resonating best so that we can be more targeted in how we approach a new market search.

Research

The Research phase is when we take what we learned in the Diagnose phase and put it into practice. If we found that we want a high percentage of millennials with above average income, which markets fit that profile?

The first step of the Research phase is to understand the level of geography relevant to the business. A home-delivery service might be interested in a county or metro area, while a business with a physical storefront might be more interested in specific cities, zip codes, or neighborhoods to look for a commercial property. For a business with home delivery, it wouldn’t make sense to target an area the size of a zip code, just as it might be too broad to give a storefront business a whole metro area for consideration.

Second is to define the search area. Some businesses want a nationwide search, while others want a search concentrated to specific regions, states, or cities. Small and midsize businesses oftentimes benefit from proximity to current operations. It’s hard enough to manage multiple locations or markets, and when that new market is a 6-hour flight on the opposite coast in a new time zone in a new business climate, the challenges can be further compounded. This makes defining the search area an important step because it helps make the most efficient use of time and resources by excluding states or regions where you couldn’t see yourself doing business yet.

Key to the Research phase is putting guardrails or parameters around how we’re looking for a new market, based on what was found during the Diagnose phase. We transition the conversation from being a series of states or regions for expansion to only areas that fit certain success criteria.

Let’s say we’re interested in opening a new higher end fitness brand, like a Title Boxing, in the Southeast region of the United States and we’re interested in looking at the zip code geographic level. We’ve gone through the diagnose phase and found that zip codes where there are currently Title Boxing locations have 40,000+ population, have population growth of 8%, have typical household income of ~$82,000, and have ~15,000 employees working in the zip code.

Zip code profile for Title Boxing locations between VA and FL

We can turn this information into our guiding criteria for research. We’ll take a more conservative approach and look for zip codes with 25,000+ population, primary city population of 150,000+, growing population, household income of $75,000+, and a high percentage of the population in the workforce.

This simple set of data-driven criteria — gleaned from the Diagnose phase and implemented in the Research phase — immediately reduces us from almost 4,000 zip codes to just 54 that meet the above criteria.

The goal of the Research phase is to eliminate the markets that have very low likelihood of being successful for your business so that more time, attention, and effort can be spent on researching and prioritizing the areas that do show stronger potential.

Prioritize

The last step in the process is to move from an unstructured list of potential markets to a structured and prioritized list. Just because a market fits the initial screening criteria doesn’t mean that all markets are created equal. Understanding that there are 20 potential markets is helpful to know from a big picture perspective or when preparing to take on outside investment, but businesses that are in growth mode also want to know which market should be entered first, second, etc.

We typically do this through creating a scoring function with key data points. We’re looking for markets that, for example, have high market size and above average income and lower than average competition and…etc. Data should rarely be viewed in isolation. Multiple data points brought into a single view give a clearer picture than any individual data point of the potential for a market.

A couple of the ways that we think about prioritization are:

Geographic Proximity: Should markets closer to current operations be given higher weight?

Demographic Fit: Which are the right metrics to weight higher, and what is a “better” or “good enough” value for those metrics?

Business Considerations: Beyond the data, are there any additional factors that should influence a market upward or downward?

Data is interesting, but direction leads to action. The Prioritize phase moves from data-driven to business-driven and gives the business the ability to shape the output beyond the pure numbers. Business owners and operators with decades of experience will bring several considerations to the conversation not readily apparent or “capturable” in the data, and the goal of the Research then Prioritize phases are to narrow and focus the conversation about these considerations to high-potential markets.

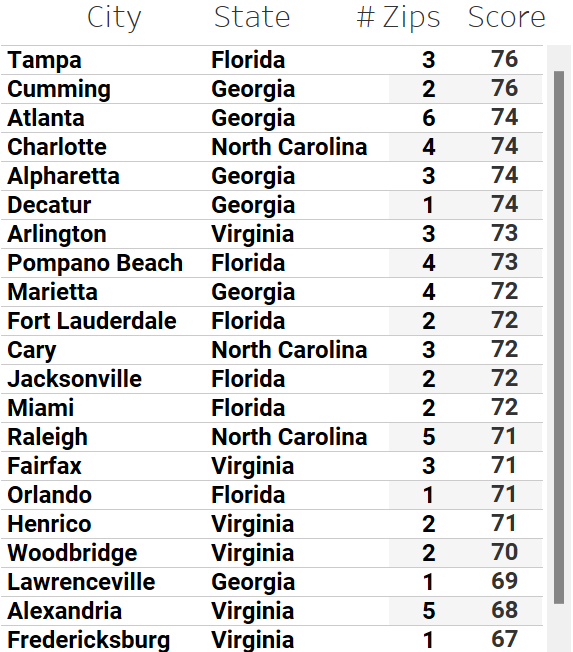

Returning to our fitness example, there were 54 zip codes in our target region that met the guiding criteria. We can’t open next month in all 54 zip codes, so which should we pursue first?

Here, we’ll create a scoring algorithm using population, income, economic activity (presence of other businesses), competition, and workforce composition. We can assign a weighting to each based on their importance to our success, like 10% for population size, 10% population growth, 20% for level of competition, etc. This weighting suggests that population size and growth are equally important, while level of competition is more important to how successful a market could be.

This is where we can customize and give relative hierarchy to our data. A business might decide that, once the minimum population size threshold is passed, this variable becomes less important, while level of competition becomes more important. This is where we can incorporate the feedback by lowering the importance of population size and increasing that for level of competition. The final output is a fully customizable and interpretable score between 0 and 100, where closer to 0 is worse and closer to 100 is better.

For the fitness example, we’ve aggregated the results to the city level - in Tampa, there were 3 zip codes that met the minimum criteria, and using the scoring function above, these zip codes aggregated to the highest average score of any city. Next is Cumming Georgia, then Atlanta. This approach allows us to see both the cities that score highly, and the specific zip codes in each city to pursue further. We can use the output to say “let’s take a close look at the Tampa market first”, and specifically whether we like the opportunity in zip codes 33629, 33626, and 33647.

The Prioritize phase leaves us with an interpretable, customizable, targeted list of markets for expansion, all of which meet our minimum criteria to succeed.

Then What?

The research is done, the markets narrowed, and the list prioritized. Now what?

Now it’s time to get operational! Depending on the nature of the business, this might mean developing opportunity maps for where to look for commercial properties, target a marketing campaign, or search for an acquisition. It could mean picking just one market to show future investors the playbook, then already having the remaining markets ready to show the further growth opportunity. Or, after evaluating the options, the best option might be doubling down on growth in current markets. Whichever path a business chooses, the options are now more targeted, focused, and using more of the available information.

This doesn’t guarantee success, but it leads to a much better chance of it, particularly for consumer-facing businesses that haven’t gone through this type of exercise before.

Interested in this topic? Get in touch with me here or by email at jordan@jordanbean.com.