Brand Research: Crumbl Cookies’ Explosive Growth

Crumbl Cookies is one the country’s fastest growing dessert concepts. The brand’s growth has been remarkable and they’re blanketing the country with locations.

Dessert-inspired concepts are not unique, nor are cookie concepts. A few already at scale are:

Insomnia Cookies: ~250 locations; in business since 2003

Great American Cookies: 400+ locations; in business since 1977

Mrs. Fields: 130+ locations; in business since 1977

Crumbl broke through the noise and has more locations than these 3 competitors combined, despite being just 6 years old. They’ve opened more stores in the last 9 months than Insomnia in the last 20 years.

How does a company grow from 1 location to 860+ in 5 years? What has the growth path looked like for the brand? Is it sustainable?

We broke down the business strategy, growth strategy, and continued expansion opportunities for the brand to show how they’ve reach their current state and where growth will be next.

WHY: THE BUSINESS STRATEGY

What makes Crumbl unique? Of the many options available - including baking a cookie at home - why do customers choose them?

The first answer is social media. From bright pink boxes to eye-catching cookie designs, the brand was built from the ground up to be optimized for social media.

Customers have responded. Crumbl has ~7M TikTok followers and ~4M Instagram followers.

These numbers are high, and they’re astronomical compared to competitors. Social media plays a clear role in generating brand visibility and affinity.

Axes for each platform are independent.

Second is variety. The cookie menu changes every single week. Menu drops have become a regular feature on their social media profiles. This generates buzz and excitement to further promote the brand.

Third is technology. As a brand built over the past couple years, there are no legacy systems to integrate or institutional inertia slowing them down.

Modern customer-facing technology enables digital orders. Internal technology enables timely data collection and operational planning.

Crumbl has a keen sense of what it takes to build a modern consumer-facing brand - a social-media worthy product, creating urgency to visit through constant menu changes, and a tech stack that drives value both externally and internally.

WHERE: CRUMBL’S PATH FROM 1 TO 860+ LOCATIONS

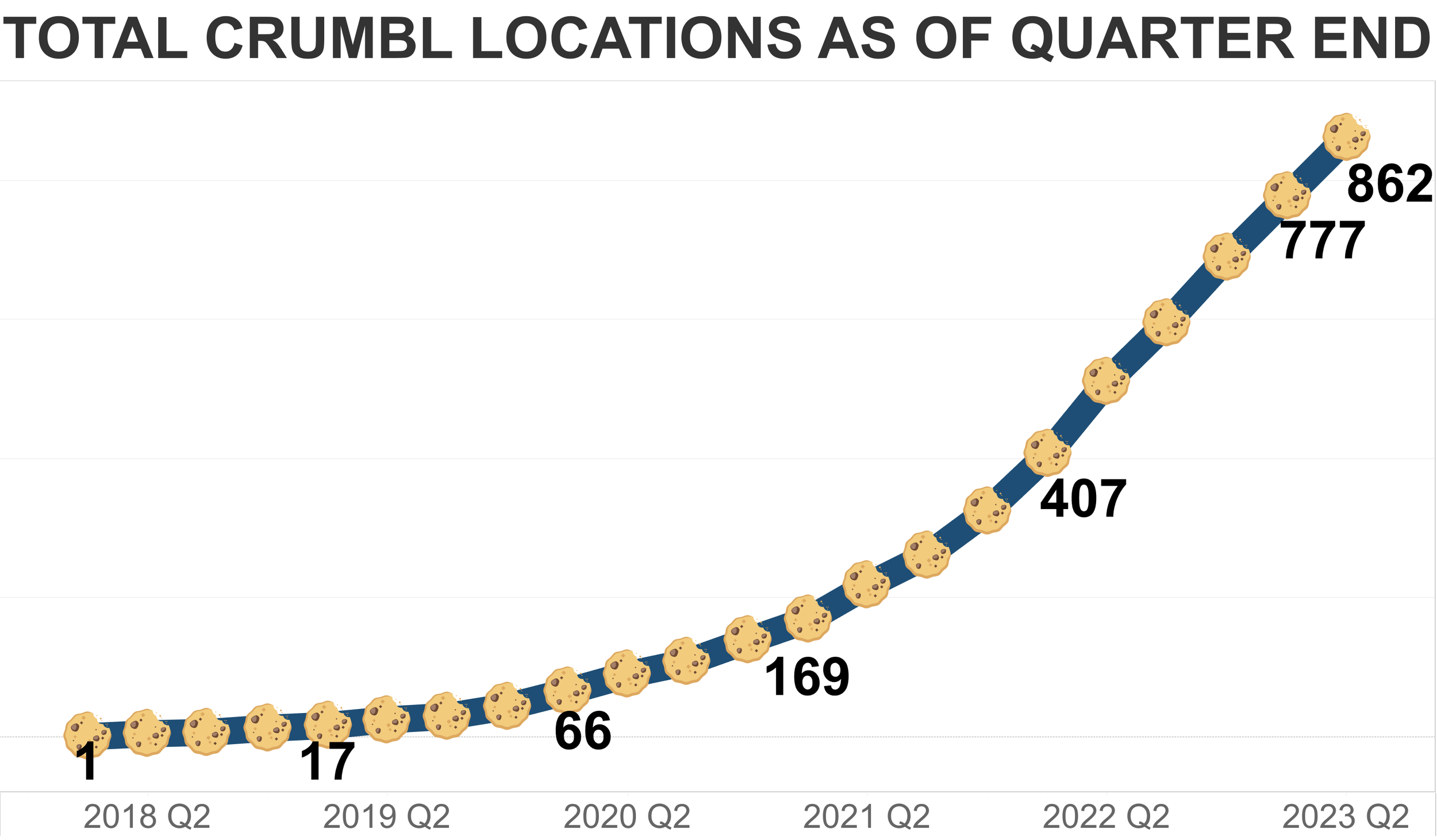

Starting with just a single location opened in 2017, Crumbl operates 862 stores as of when we sourced this data in early July, up from 511 in the same period last year.

Between the end of 2022 Q1 to 2023 Q1, the brand nearly doubled its location count from 407 locations to 777, and added the equivalent of a store per day.

There are few signs of slowing down - 87 and 85 locations were opened in the last two quarters respectively.

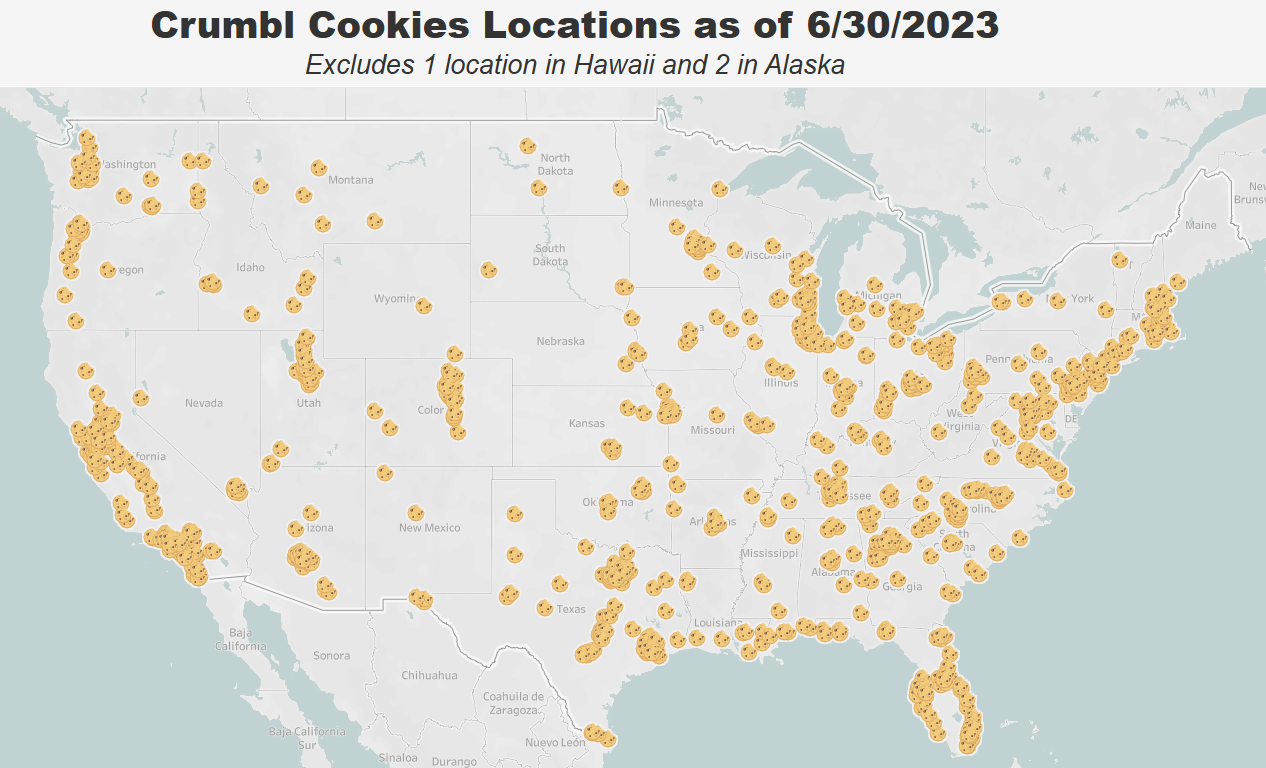

These stores are dispersed across the United States. Every state has at least one location with the highest store counts in:

California (127)

Texas (92)

Florida (63)

Areas with higher store count generally align with places that have a higher population, with some notable exceptions.

New York City, for example, is not on the list of top metros despite being the largest market by population size (more on them later).

Even though these are the largest markets today, growth didn’t start in large urban metros.

Early in their growth trajectory, Crumbl opened closer to their home base in Utah and nearby western states.

Among their first 100 stores opened, 21 were in Utah, more than any other state. Three of the other 4 top states bordered Utah.

Since the 100th location was opened, California, Texas, and Florida have consistently held the top three spots across each phase of growth.

Beyond these three states, growth has been dispersed. Across our 5 phases of growth segmentation tagged above, 14 different states have held a spot in the top 5 states by locations opened.

States like Virginia and North Carolina were more prominent early in their growth journey (stores 101-250) while more recently Georgia and New York have been higher growth states.

HOW: FRANCHISING

Crumbl locations are franchises, not company owned.

Data reported in Crumbl’s franchise disclosure documents shows that franchisees pay a $50,000 franchise fee for the right to open a location and an 8% royalty on gross sales, among other ongoing fees and upfront costs.

The average revenue at a Crumbl location is nearly $1.8M - 50% more than a typical Starbucks.

According to their franchising website, there are not any current territories available - in effect, they’re saying they’re sold out of future franchise opportunities in the US right now.

Franchising works by assigning territories. An operator signs on for the right to operate in a given area with certain size or other characteristics.

Let’s take a look at an example market with higher saturation, Nashville, to see how this plays out for Crumbl.

There are currently 12 stores in the Nashville metro. These stores, on average, are 5.7 miles apart, but this obscures a more targeted pattern.

Stores in denser areas - tagged with red buffers below - are between 4.75-5.75 miles apart while stores in less dense areas - tagged with blue buffers below - are 7-13 miles from the next closest store.

In the radius surrounding these stores - defined as half the distance to the next closest location (in order to avoid overlap), the population is between 20,000-140,000.

Locations with lower surrounding population tend to be either:

Near tourist-driven areas that drive additional foot traffic

Near other amenity-rich places (college campuses, shopping centers, etc.)

This points to a strategic - not opportunistic - franchise strategy. All territories are not created equal and Crumbl appears to be carving up these markets in a way that drives distinct value for each location.

It’s easy to assume that such rapid growth was led by a “put a store anywhere we can” mentality, but that hasn’t been the case.

Crumbl’s franchising strategy has been methodical and targeted. There appears to be ample research behind the population, foot traffic, and surrounding area characteristics that will make a successful location.

WHAT’S NEXT: MORE GROWTH

The brand is premium for its category but “affordable” overall - cookies range from $4-$5, low enough to be an impulse purchase.

This relative affordability means it has a wider set of markets where it can successfully operate. Simply put, the brand can likely operate almost anywhere with people - residents, visitors, tourists, shoppers, etc.,

The brand is effective everywhere from dense metros to high-foot traffic suburban shopping centers to bustling college campuses, and the growth strategy to-date has been to cast a wide net before building density within markets.

There is at least 1 location in 274 distinct metro areas but 85%+ have 4 or less locations. Many of these can support more - metros like San Jose, CA (4 locations), Birmingham, AL (3 locations), or Memphis, TN (3 locations).

The opportunity is not just in building up these midsize markets. There is still significant runway for growth in the largest urban markets.

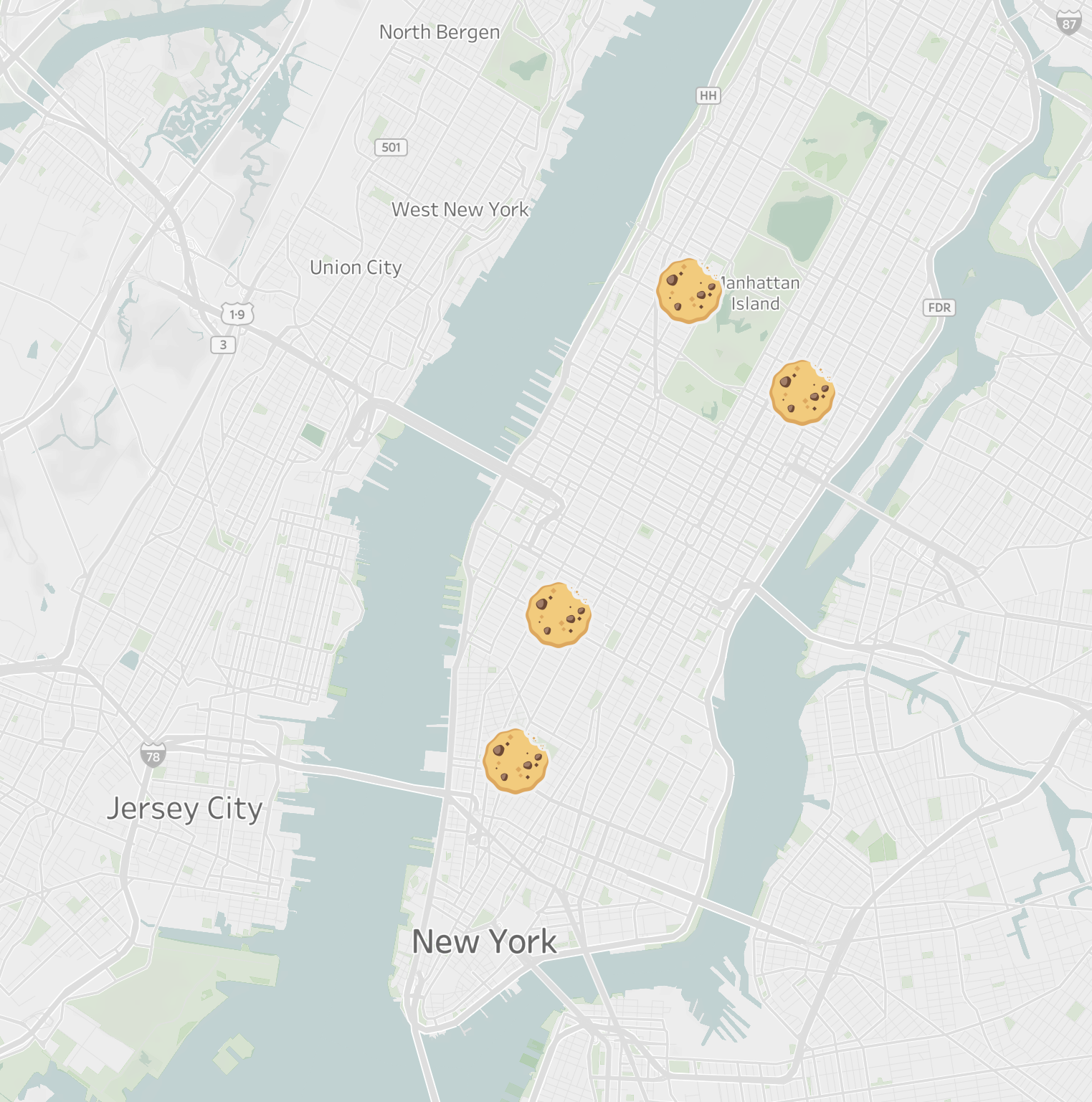

As one example, there are 5 more stores in the Houston metro (21) than the New York-Newark-Jersey City metro (16) even though the New York metro has almost 3x the population size.

Locations in the the New York metro average almost 9 miles apart, an eternity in the dense urban areas of NYC.

Zooming into the New York metro, there are only 4 locations in Manhattan (and none across the river in Brooklyn, Hoboken, or Jersey City).

This area must be high on their list for market potential.

New York City current locations.

All this to say - 862 locations doesn’t look like the end of the road. They’ve built fast, but this growth has been targeted.

We’d expect if we pull this data again at this time next year we’d see more density in current markets now that the brand has reached most markets of note in the US.

FINAL THOUGHTS

Crumbl isn’t special in the sense that they cracked a secret formula. The founders had no background in baking, food services, or food science.

Their differentiation comes from building a brand tailored for today - highly effective social media, technology-led, and creating scarcity to drive visits - in a category where no one else has brought that playbook.

They’ve executed this vision faster than almost any other food and beverage brands. It’s one thing to scale an app where an additional download or user requires little marginal cost.

It’s entirely different to do so when reliant on physical locations, yet Crumbl has still demonstrated this ability to execute on finding strong franchise partners, creating value-add territories, and building a loyal customer base through social media.

Right now, despite the rapid growth, we don’t see the biggest risk as oversaturating the market with locations. We see bigger risk in consumer fatigue.

Is it a fad or does it have legs for the long term? Is a cookie viable as a largely standalone product, or will they need to become a broader dessert brand?

These questions will be answered over time, but in the short-term, we expect more rapid growth as franchises that are under agreement open and continue to keep the brand on the path of explosive growth.

Interested in this topic? Get in touch with me here or by email at jordan@jordanbean.com.